Many people in Switzerland are concerned about how much money you should have depending on your age. Do I have more than others? Should I save more? This blog shows the median wealth of the Swiss population by age group and gives practical tips on how to build up and secure wealth at every stage of life.

Wealth is built up not only by earning and saving money, but also by investing in the financial market. Read this blog to find out when and how to start investing. But it’s definitely worth talking to an investment expert about your personal situation.

Whether you’re just starting out in your career or are already enjoying retirement, it’s important to know where you stand financially. Having a clear idea of how your assets compare to others in your age group can help you to better plan and achieve your financial goals.

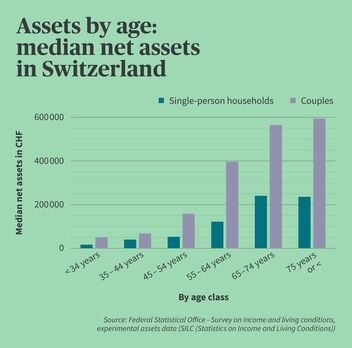

The chart shows net household assets. This means: mortgage, debt, and payment arrears are deducted from gross assets in the same way as assets from Pillars 2 and 3 that are yet to be withdrawn.

Median net wealth of single-person and couple households Source: FSO – Survey on income and living conditions, experimental assets data (SILC (Statistics on Income and Living Conditions)), as of: 11/2022

Net assets include:

However, it can be assumed that assets will tend to be underestimated . This is because extremely high incomes are often missing from the data and the data collection methods are experimental in nature. This also applies to the data from the graphic.

The asset chart shows how median assets increase steadily in small steps and increase noticeably in the 55+ age group. Reasons for this include lump-sum payments from retirement provision or inheritances.

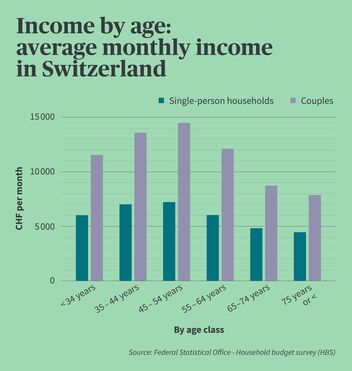

A look at the development of average income (see chart) by age group clearly shows that saving and investment behavior are also decisive for long-term asset accumulation.

Average gross income of single-person and couple households Source: FSO – Household Budget Survey (HBS), as of: 02/2023

Gross income includes all income (wages, pensions, social benefits, alimony) before the deduction of compulsory expenditure (social security, taxes, etc.).

The data make it clear: The difference in gross income between age groups is small until retirement age. Assets cannot therefore be built up solely by means of rising income.

The best way to explain the difference is to give an example – let’s take assets:

Average assets are calculated by dividing the total assets of a group by the number of persons in that group. However, this can be distorted if some individuals have extremely high assets.

Median assets, on the other hand, represent the value at which exactly half of the people have lower and the other half higher assets. This provides a more realistic picture of how the “typical” person in an age group is doing financially.

Asset accumulation is a lifelong task that offers its own challenges and opportunities at every stage of life. Here are some tips on how to build up and secure assets in different age groups.

Your 20s are all about creating the foundation for a solid financial life. Since many young people are only at the beginning of their careers, their assets are often still low. This is the best time to start saving and investing because spending is often not as high as in later stages of life.

Your 30s are often marked by major changes such as starting a family or buying a property. This also changes financial planning:

In your 40s, assets usually grow continuously and stability returns in your life. Now is the time to consolidate your investment decisions and minimize risks.

By age 40, you should ideally have saved at least CHF 50,000 – which is the median amount of assets in Switzerland for this age group. However, financial experts recommend accumulating two to three times your annual gross income as assets. For an annual income of CHF 80,000, this would be between CHF 160,000 and CHF 240,000. This money can be held in Pillars 2 and 3, in savings accounts, or in other investments.

As you approach retirement , it’s time to re-examine your financial plans. How much money will you need in retirement? Where will it come from?

In retirement, the focus is use of assets. The focus should now be on preserving assets in order to secure your standard of living.

The differences in wealth between age groups are clear and are influenced by a number of factors: income, savings, investments, and inheritance play an important role.

We therefore recommend that you start accumulating assets – regardless of your age group.

If you think you don’t have the money to invest, we can reassure you: Even smaller investments are absolutely worthwhile. And since there are a great deal of potential savings in insurance, you can build up your assets steadily, even with a lower income.