Key points at a glance

- You only pay for what you actually want: Our travel insurance is made up of modules that can be combined to suit your needs.

- Comprehensive no-worries travel protection: Travel cancellation insurance and Personal assistance protect you no matter where you are in the world. Roadside assistance covers you throughout Europe and for much more than just a breakdown.

- Individual add-on modules: Expand your travel coverage with modules that perfectly align with your needs.

Need help buying insurance? Call us at 052 244 86 12

Insurance coverage as individual as your travel plans

Whether you’re planning a summer vacation on the beach, a trip to a European city or a cycling tour across Switzerland, with our travel insurance, you can relax and enjoy your vacation and travels.

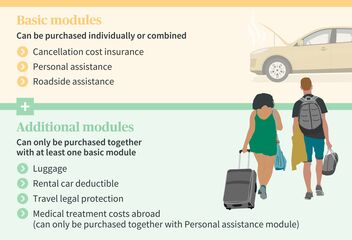

- Intertours travel insurance consists of three basic modules: Travel cancellation insurance, Personal assistance and Roadside assistance. The basic modules can be purchased individually.

- The following add-on modules provide even more protection for your trip: Luggage, Rental car deductible, Travel legal protection insurance and Medical treatment costs abroad. These add-ons can be purchased in combination with at least one basic module.

Travel protection tailored to your needs

Create a travel insurance package that best serves your needs. You can purchase our basic modules individually, or combine them any way you like. The add-on modules must be purchased together with at least one basic module.

Calculate your travel insurance premium now and buy a policy with just a few clicks

Single-trip travel insurance

You can even take out travel insurance with AXA shortly before you leave on your trip. Single trip travel insurance from AXA (short-term policy) offers you worldwide coverage for a single trip. There are seven modules that you can combine as you like to create your travel insurance policy so you can leave your worries behind when you go on vacation.

Your advantages:

- Insurance coverage for individual trips and for up to 11 persons (family, friends, acquaintances – of whom, max. 5 people under 18)

- Buy it online as late as the day before you leave and pay with a credit card or PayPal

- Individual travel protection – seven modules to choose from and combine

- Trip duration of up to 125 days (beginning and end will be defined when you take out the policy)

- Worldwide coverage

- No deductible (except for Luggage add-on module)

- No cancellation necessary (the policy will automatically expire once your trip ends)

Your advantages with AXA travel insurance

Travel insurance: Download all the information

Claim scenarios

FAQs about travel insurance

When is it worth buying travel insurance?

Regardless of whether you are looking for insurance for a vacation or a travel policy for a longer stay, travel insurance from AXA has you covered. Our policy lasts for 3 years, but you can cancel at the end of each year.

Our travel insurance is great for

- A single trip

- Quick trips

- Trips around the world

- Semesters abroad

- Adventure trips

- Diving trips

- Beach trips

- City trips

Whenever you are traveling in Switzerland or abroad, you can count on the benefits offered by AXA travel insurance from the instant you book your trip.

How much does Intertours travel insurance cost?

The price you pay for your premium depends on which modules you choose. You can use our premium calculator to quickly and easily see how much it will cost.

How much is the deductible?

There is no deductible for any of the basic modules or for the Rental car deductible, Travel legal protection or Medical treatment costs abroad add-on modules. Loss events that are covered are compensated in full.

Is my luggage insured?

Yes. Our Luggage insurance add-on module protects you from financial loss if your luggage is lost, stolen, damaged or delivered late while you are traveling.

This add-on can only be purchased together with at least one of the three basic modules.

How long before my trip begins do I need to purchase travel insurance?

The travel policy goes into effect immediately on the date when you sign the contract. You are also insured if you take out a policy on short notice. But please note that events that happened or were apparent before you took out the insurance or booked your trip are not insured.