Buy or rent? Buy! Over recent years, the run on real estate has increased sharply. But owning a property depends essentially on long-term financial affordability. If you’d like to buy a house, you should carefully review your financial situation.

Buying a "place of your own" is still one of the most important life goals in Switzerland. With good reason, as mortgages and amortization are mostly cheaper in the long term compared to renting a house or apartment for decades. Home ownership also has tax benefits and creates a solid investment in uncertain times. Nonetheless, the growth in demand has driven up real estate prices. That's why potential buyers with a limited budget are often uncertain about whether home ownership in Switzerland is affordable for them at all. We’ll show you what you have to look out for. Our affordability checklist also gives you a practical starting point.

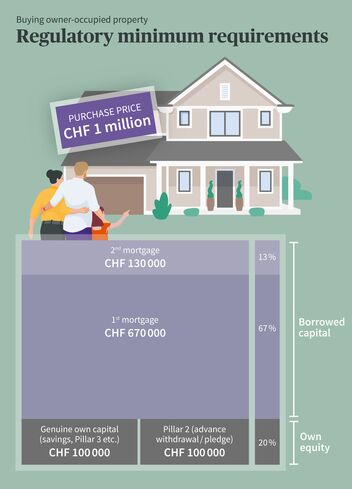

Using the 20:80 rule, at least 20 percent of the property's value must be funded using your own equity. The remaining 80 percent of the purchase price may be funded using borrowed capital. At least these are the regulatory requirements – some banks and other mortgage providers have much stricter criteria for lending. Half of the equity must be "genuine" equity, such as savings, securities, inheritance advances, and gifts. The other half must be in the form of an advance withdrawal from the pension fund (Pillar 2).

Please note: In addition to the 20 percent equity, you should still have enough cash to cover the ancillary purchase costs (e.g. notary, land registry, debt certificate, property transfer tax, etc.). In Switzerland, this expenditure varies between 1 and 6 percent of the real estate price.

The more of your own capital you put towards a property, the lower the interest burden. But be careful never to put all of your liquid funds into home ownership: if you suddenly need money due to an unforeseen event, then it’s tied up and you’ll be faced with a liquidity bottleneck.

Tip: voluntary Pillar 3 is ideally suited for saving money to buy your own home. And with Pillar 3a, you’ll also optimize your tax every year.

Source: Own depiction

The housing costs for your property should not exceed one third of your gross income. This is the only way that buying a property is affordable for you over the long term. Apart from mortgage interest, there are also amortization and maintenance costs to be added to housing costs. Note: Regardless of the current interest rate level, a long-term average interest rate of 5 percent – known as imputed mortgage interest – is used to calculate the maximum mortgage loan in Switzerland.

Mortgages in Switzerland are granted by banks, insurance companies and pension funds. The amount of money they'll lend you to buy a property depends on your income and assets. In the first instance, you should therefore check with your bank or insurance company to determine how high your loan can be. Our mortgage calculator helps you work out whether you can afford the home of your dreams.

Secondly, find out which model is the right one for you, i.e. fixed, SARON or variable rate mortgage.

As soon as you have found the right mortgage model, it becomes specific: Obtain three to five quotes from different providers for the same product and the same reference date. Compare the terms and conditions, making sure to read the small print as well. Here you'll find out everything important if you're interested in a mortgage with AXA.

First mortgages are up to 2/3 of the property value. If you need more borrowed capital, you still need a second mortgage. However, this must be repaid within 15 years. Together, the first and second mortgages can finance a maximum of 80 percent of your own home – as at least 20 percent must be contributed in the form of your own capital.

Banks calculate that maintenance and ancillary costs for a house are between 0.7 percent and 1 percent of the total value. For a single-family home valued at CHF 1 million, this would mean CHF 10,000 per annum. Even if this amount seems high, it's realistic: building insurance, water and sewage, fuel and garbage disposal as well as maintenance, repairs and replacement of appliances - it all adds up. For older properties, maintenance costs of up to 2.5 percent should be factored in. Platforms such as newhome help you compare different real estate offers and get a realistic picture of the potential costs.

The second mortgage must be repaid within 15 years. This can be done in two ways:

Direct amortization reduces the mortgage debt and interest burden, However, the tax burden is increasing due to falling debt interest rates.

With indirect repayment, the mortgage debt, interest expense and tax liability remain the same. Thanks to integrated insurance coverage for insurance solutions, affordability is guaranteed in the event of disability or death.

House construction insurance covers damage to your own building, such as collapsing ceilings or toppling walls.

Construction owner's liability insurance protects builders and home owners against financial claims in the event of a liability case.

Legal protection insurance for construction owners insures private construction owners – for example, in the event of disputes over hidden defects on the construction project.

Fire and natural hazards insurance is the basis of building insurance and is compulsory in most cantons (apart from GE, VS, UR, SZ, AI, OW, TI).

Water insurance covers you against damage caused by, for example, frost in water pipes or blockages in the sewage system.

Earthquake insurance closes a risky gap: most buildings in Switzerland are not insured against earthquake.

Occupational disability insurance protects you and your family against major loss of earnings as a result of accident or illness.

Term life insurance ensures that even if you die, your nearest and dearest will still be able to continue funding home ownership and ongoing loans.

Even though the second mortgage is supposed to be paid off before you retire, housing costs drain the limited budget of retirees. In this instance, you have three options:

Reviewing your advance planning for retirement should help you decide on the best solution for you. Either way, however, you must have saved the necessary capital in good time. You should therefore take advantage of the times in which you can set something aside. A good way of doing this is through Pillar 3a – ideally in conjunction with term life insurance.

The funding is by some way not the only relevant factor when it comes to home ownership. A number of factors have to align for you to be happy with a property over the long term. In any event, it's worth waiting for the offer that suits you best.

In the meantime, you can calmly prepare the funding for your own home. Our affordability checklist will guide you through this process.