EasyInvest discretionary management is exactly what modern portfolio management should be: an investment portfolio that is specifically tailored to your needs, professionally managed, easy to use and gives you flexible access to your assets. EasyInvest lets you invest like a pro and puts your money to work for you. It couldn’t be easier.

Sign up in the myAXA pensions portal

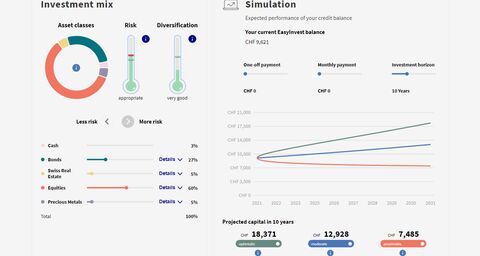

Determine your risk profile and investment mix

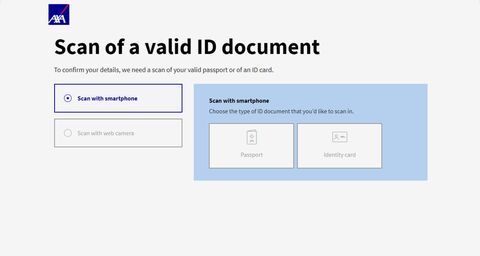

Verify your identity and sign the contract

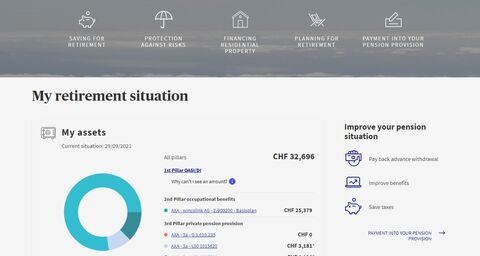

Set up your EasyInvest investment profile now to get secure online access to your investment account any time you want.

Go directly to myAXA | Information about our customer portal

Would you like to help manage your investment risk? Then customize the parts of your investment portfolio you want to control. Would you rather not have to bother keeping up with the stock markets? Then take advantage of AXA’s extensive investing expertise. EasyInvest gives you both of these options.

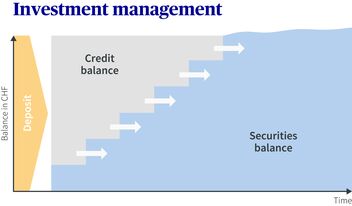

Use investment management from EasyInvest to stagger the money you pay in and keep building up your assets over time.

In order to better protect investors, Switzerland passed the Financial Services Act (FinSA) in January 2020. Below you will find related information about the duties of conduct, implementation and organization required of AXA Insurance Ltd.

Please note that the information and documents published on this website constitute advertising under Art. 68 of the Swiss Financial Services Act (FinSA) and are provided for information purposes only.

Do you have any questions about investing or would you like a no obligation financial or retirement planning consultation? Our experts are there for you.

The purpose of Pillar 2 is to enable people to maintain their accustomed standard of living after retirement.

More and more people are working part-time in Switzerland. If you don’t actively manage your retirement, you could end up with a massive gap.

As retirement draws nearer, you need to consider how you want the money you’ve saved in your pension fund paid out.