Key Points at a Glance

- Flexible investment split: You decide how much you want to invest in return-oriented equity investments (return-oriented capital) and how much in security-oriented fixed-income investments (safety capital) – completely in line with your needs.

- Financial advantages: You save on taxes as no income tax is due on dividends or interest payments, provided certain criteria are met. You can also benefit from inheritance and bankruptcy privileges.

- Attractive preferential interest rate: You currently receive an attractive preferential interest rate of 2.2% on the safety-oriented part of the investment.

Arrange an appointment: 052 269 21 67

Who can benefit from a capital investment?

A capital investment aims to generate long-term returns and to increase the money invested. This method of accumulating capital is particularly suitable for anyone wishing to start their retirement and estate planning at an early stage.

The SmartFlex capital plan for pillar 3b offers an ideal solution. It is worthwhile making this capital investment in plenty of time before retirement, as a minimum term of 10 years is required for the tax advantages. The assets saved will be paid out at the end of the term or in the event of death.

Thanks to low fund costs and attractive tax advantages, and due to the medium- to long-term investment period, the capital plan offers the opportunity for higher returns compared to traditional bank accounts.

How the SmartFlex capital plan works

Flexible allocation of investments

You decide how much of your capital is invested in equity funds as return-oriented capital and how much is invested as interest-bearing safety capital. Reallocations between return-oriented capital and safety capital can be made at any time.

Frequently asked questions on the SmartFlex capital plan

What does the SmartFlex capital plan do better than other investment solutions?

As capital insurance, the SmartFlex capital plan offers the following advantages over a bank investment:

- Tax advantages: No income tax is due on dividends or interest payments, resulting in tax advantages.

- Asset protection in the event of debt collection proceedings or bankruptcy: The capital investment is protected in favor of the family in the event of enforcement proceedings.

- Inheritance planning: Makes it easier to transfer assets by paying out the capital directly to the beneficiaries in the event of death.

SmartFlex differs from other capital insurance policies due to the following additional services:

- Investment management: The staggered investment of funds reduces the risk of unfavorable timing.

- Earnings protection: The investment income is protected regularly and can no longer be lost.

- Contract maturity management: The investment risk is reduced towards the end of the contract by gradually reallocating the return-oriented capital to the safety capital.

Which criteria need to be met in order to benefit from the tax advantages?

No income tax is charged on the interest and dividends received, and the payout is tax-free if the following criteria are met:

- Contract concluded prior to the age of 66

- Contract term of at least 10 years

- Payout from the age of 60 at the earliest

- The policyholder and the insured are identical

How much do I need to invest?

With the SmartFlex capital plan you benefit from the advantages of capital insurance starting from a one-time deposit of at least CHF 15,000 (pillar 3a) or CHF 25,000 (pillar 3b).

Do I need any special knowledge or experience to take out the SmartFlex capital plan?

No. Your pension advisor will explain everything you need to know in a way you can understand. We will clearly point out the risks, opportunities, developments, and costs of your personal solution.

What costs are payable with the SmartFlex capital plan?

The fees for SmartFlex are comprised as follows:

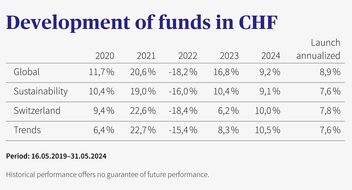

- Fund costs: 0.20% – 0.42% p.a., depending on the investment theme

- Overall costs: shown individually in the offer

- One-time stamp duty: 2.5% of the single premium (3b flexible retirement saving)

The annual tax savings usually exceed the stamp duty after around four years (depending on income tax, interest payments, and dividends). Capital insurance is thus more advantageous than a bank investment over a medium- to long-term horizon.

Some more interesting reads for you

Further information to help you plan your financial future.

Part-time and pension funds

More and more people are working part-time in Switzerland. If you don’t actively manage your retirement provision, you could end up with a massive pension gap.

Annuity or lump sum? Which is better?

As retirement draws nearer, you need to think about how you want the money you’ve saved in your pension fund paid out.

Building up a pension

When choosing a suitable provider for a pension solution based on Pillar 3a, interested parties are quickly faced with the question of whether to choose a bank or an insurance company.