Key points at a glance

- Comprehensive coverage for your building: Building insurance protects you against the financial consequences of loss due to fire, natural hazards (such as floods or storms), water (e.g. from pipes), glass breakage or as a result of a burglary.

- Select just the coverage you need: Every building is different. This is why you can choose just the add-ons you want for damage to the building’s surroundings, structural installations, equipment, materials and more. We’ll be happy to advise you.

- Photovoltaics, solar power systems & heat pumps: Our comprehensive coverage for building technology insures systems that use renewable energies. In addition to damage and destruction, you can also insure loss of earnings due to lost power generation.

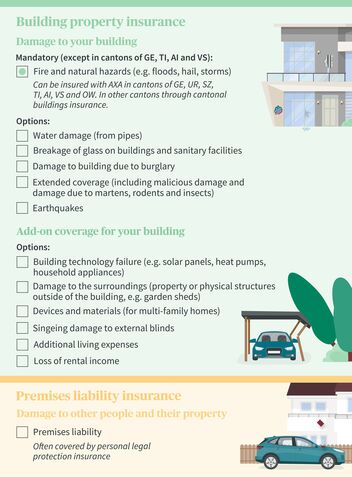

Building property insurance

Protect yourself against financial loss resulting from building risks with AXA’s flexible suite of insurance solutions. Create a building insurance package that best serves your needs.

Fire and natural hazards

Almost all of the cantons in Switzerland require you to insure your house against damage caused by fire and natural hazards, such as flooding, hail or falling rocks. You can take out this insurance through AXA in the cantons of Geneva, Uri, Schwyz, Ticino, Appenzell Innerrhoden, Valais and Obwalden. In the remaining cantons, you are required to insure your property against fire or natural hazards with the cantonal buildings insurance authority. Learn more here.

Additional building insurance coverages:

- Water damage: Water damage is a big risk because pipes can burst or freeze

- Damage due to glass breakage: Damage to glass, such as window panes or sanitary installations

- Damage to building due to burglary or attempted burglary

- Extended coverage: Malicious damage or damage resulting from martens, rodents and insects, among other things, is also covered

- Earthquakes

Add-on coverages for your entire building:

- Building technology failure: Damage to photovoltaics, heat pumps, household appliances, etc. due to breakdowns, electronic failure, including loss of earnings when energy cannot be fed back into the grid

- Damage to the surroundings: Property or physical structures outside of the building, e.g. pathways, stairs, garden sheds, swimming pools and landscaping design elements (no plants)

- Equipment for building maintenance (for multi-family homes)

- Singe damage to external blinds: i.e. damage due to scorching and heat that are not the result of flames or fire

- Additional costs for temporary housing: If the owner-occupied residence is damaged, there will be the added expense of paying rent for temporary housing

- Additional costs resulting from the loss of rent: If tenants are unable to use individual rooms or the entire apartment or house due to damage

Premises liability insurance

The law clearly states when you can be held liable for damage caused by an accident if you own a house or property. This type of damage often is the result of structural defects or a lack of maintenance. If you forget to salt the front walkway when it’s icy, for example, you can be held liable if an accident happens.

Liability insurance from AXA will protect you against these types of claims for damages from third parties and defend you against unsubstantiated claims. In many cases, you won’t need separate premises liability insurance because you will already be insured under another policy. As an example, AXA’s personal liability insurance will cover, among other things, owner-occupied properties with up to three apartments. As insurance coverage varies from one company to another, you should check whether premises liability insurance would be a good fit for you.

Examples of damage/loss

Support and frequently asked questions

Is earthquake damage covered by building property insurance?

No, most buildings in Switzerland are either not covered or insufficiently covered against the consequences of earthquakes. With our supplementary insurance, "earthquake insurance," you can insure your building against this risk.

Must I have building insurance against fire and damage from natural forces?

In most cantons, house owners are required to take out building insurance against fire and damage from natural forces. The cantons of Geneva, Ticino, Appenzell Innerrhoden and Valais are exceptions to this rule – there you can insure yourself voluntarily. You can only freely choose your coverage in the following cantons:

- Geneva

- Uri

- Schwyz

- Obwalden

- Ticino

- Appenzell Innerrhoden

- Valais

In the remaining 19 cantons, you are required to take out the corresponding cantonal building insurance.

For minor conversions to my own home, do I need to take out separate construction insurance?

No, loss/damage from minor renovations and repairs up to a construction amount of CHF 100,000 are covered by AXA’s building property insurance.

Can I insure my heat pump or solar energy system against damage?

Yes, with our supplementary insurance, "Building technology failure," you can insure the technical systems of your building against destruction and damage.