Nowadays part-time work is common practice and particularly popular in Switzerland. 37% of the working population works part-time. This puts Switzerland in second place in the European ranking; the only country with more part-time jobs is the Netherlands (64%).

The majority of these employees are women; they are three times more likely than men to work part-time. Six out of ten women now work part-time (source: Swiss Federal Statistical Office, 2022). The reason for this is often the difficulty of uniting job and family. We explain to women how they can make secure and independent provision despite working part-time.

Many women welcome part-time work, because a full-time job is only manageable with difficulty or not at all if the woman has children. But what's all too often forgotten when it comes to part-time jobs are the associated income and pension gaps. It goes without saying that you earn less if you work less, and that you pay less into the pension fund.

And it's these missing contributions that have an impact on Pillar 1 and Pillar 2 pensions and can reduce women's pensions over the long term. And the impact is even greater if she takes a complete break from work to bring up a child, for example, leading to pension gaps. Women therefore frequently draw low pensions. Private pension provision helps women increase their pensions and maintain their accustomed standard of living even after retirement.

The Swiss Conference of Gender Equality Delegates recommends women not to let their workload drop below 70% in the long run. For those for whom this is not possible, however, there are other options to save and provide for old age, for example by making contributions to Pillar 3a or with capital investments.

The fact is that part-time working reduces the later benefits under Pillar 1. Anyone wanting to receive the maximum OASI pension of CHF 2,520 (as at 2025) must earn an average annual income of CHF 88,200. Many women working part-time fail to achieve this level of income.

When contribution gaps arise – for example, as a result of maternity leave – only partial pension benefits are paid, which are lower. Every missing contribution year leads to a pension cut of 2.27%. If you want to avoid this, you must pay the annual OASI minimum contribution of CHF 530 (as at 2025). Nonetheless, gap-free payment is not possible for all women. You can therefore request a statement of your personal OASI account from the compensation fund. If you thereby discover a payment gap, you can close it by making the missing payment within five years.

Good to know: If you are raising children or looking after relatives in need of care, you can have this credited to the OASI. These are so-called education and care credits.

In Switzerland, employers must only admit employees to the pension fund if their annual income exceeds CHF 22,680 (as at 2025). This often leads to major disadvantages for part-time workers and their occupational benefits insurance (OPA).

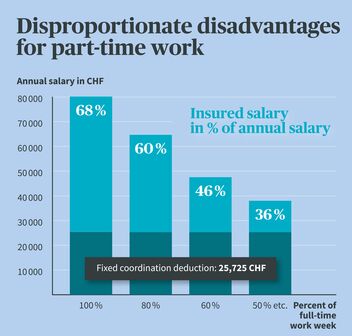

For part-time employees, the "coordination deduction" is an additional disadvantage: This is deducted from salary and currently amounts to 7/8 of the maximum OASI pension, or a deduction of CHF 26,460 (as at 2025). If you work in several part-time jobs, the coordination deduction may even be deducted more than once. It is therefore essential that you inform yourself about the pension fund regulations that apply to you and find out whether it is possible to insure your various incomes through a single pension fund. The coordination deduction will then only be applied once.

The coordination deduction is a fixed amount deducted from the annual salary in order to determine the amount of insured salary. Pension fund contributions and pensions for old age, children, survivors and the disabled are based on the insured salary. Part-time workers pay the same coordination deduction as those who work full-time, unless the employer has specified a reduced coordination deduction for part-time workers in its pension fund regulations.

If a woman is to ensure that part-time working does not become a pension trap, she should take action herself, prevent risks and insure herself. The keyword here is private provision. This is because relying on the state pension (Pillar 1 and Pillar 2) is not enough today to be able to maintain your accustomed standard of living in retirement. Pillar 3 / Pillar 3a offers an ideal opportunity to close pension gaps and to save for later on. It is the voluntary and flexible supplement to mandatory pension provision under Pillars 1 and 2.

Under Pillar 3a you can benefit from tax advantages: By making contributions you can save up to a certain maximum amount in taxes and thereby save money. If you are a member of a pension fund, you can currently pay in up to CHF 7,258 per year. If you are not affiliated to a pension fund, the contributions amount to up to 20% of net earned income and a maximum of CHF 36,288.

Above all, it is important to start saving with Pillar 3a as early as possible because you will then benefit from long investment horizons and compound interest effects in old age. In this way, you can build up a solid private pension and achieve your personal savings goals.

The amount of money available to you in old age as a part-time working woman needs to be planned carefully and in good time. Get properly informed about saving possibilities and handle your finances realistically. It can also be economically advantageous for you to invest your capital in equities and thus improve your finances. In other words, invest in companies that distribute profits. You can then reinvest those profits and save more profitably over the long term than with a traditional savings account with the bank. And: Investing in shares does not mean gambling with your money (because you should never be frivolous with retirement assets). Risks can be minimized through broad diversification and in this case through long investment horizons as well.

Did you know that you can invest in just sustainable companies, for example, or in just Swiss companies?

The purpose of Pillar 1 is to secure livelihood in retirement, in the event of disability and incapacity to work, or after a death.

Pillar 2 includes occupational pensions, occupational accident insurance, daily sickness benefits insurance, and the vested benefits institutions. It's intended to enable people to maintain the standard of living they're accustomed to after retirement.

By making voluntary payments into a tied (Pillar 3a) or flexible (Pillar 3b) pension, you can close any income gaps from Pillars 1 and 2 of the Swiss pension system to the fullest extent possible.

Do you have any questions, or would you like a no-obligation pension consultation? Our experts are happy to help you.