Those wishing to save capital for retirement reliably and sustainably will fare best with targeted investment in diversified shares.

Until not that long ago, saving capital for private pension provision through savings accounts or conventional life insurance was enough to ensure adequate retirement provision in addition to Pillars 1 and 2. However, persistently low interest rates and demographic trends in Switzerland changed the environment for planning retirement provision. Those wishing to save sustainably for retirement while also continuing their accustomed lifestyle in their old age should invest part of the paid-in capital on a return-oriented basis, such as in shares.

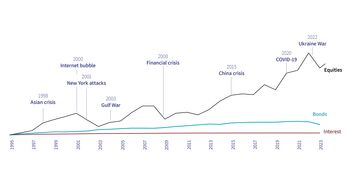

Performance of Swiss Performance Index (SPI®), January 1, 1995 to December 31, 2022:

The long-term perspective clearly shows that despite crises, shares have performed significantly better over the long term than bonds and savings accounts.

Over the last 28 years, shares have gained an average of about 7.7% per year, while the average value of bonds has risen by 2.7% per year and that of savings deposits has grown by 0.7% per year.

What is the Swiss Performance Index?

The SPI®, Switzerland's most extensive index, comprises about 200 Swiss companies. The performance of this index also reflects the performance of Switzerland's economy.

It is difficult to produce reliable forecasts in the current market environment, but it can be said that price collapses are a feature of the stock market. History also shows that crises have always been overcome, often surprisingly quickly.

Stock market turbulence should be addressed with a cool head. Pension solutions are geared towards the long term, but market turbulence is also a chance to source earnings opportunities, as buying prices are lower (average price effect).

Those who invest smartly spread their capital between different individual shares and regions to avoid cluster risk. Those who invest in AXA’s SmartFlex pension plan, for example, will be cleverly building up their retirement provision and avoiding a pension gap. The investment funds are strongly diversified and investors can choose from four different investment themes.

All good things are worth waiting for. Surprisingly, this maxim also applies to saving with shares. Keeping calm and thinking for the long-term is usually the best policy. This is because the long-term perspective on market trends of the Swiss Performance Index, for example, over the last 25 years shows that despite crises, equity investments fare much better than savings accounts or bonds in terms of appreciation.

Those who also wish to invest in shares to achieve their savings goals should take a close look at the costs involved. Excessively high costs lead to a substantially lower return. The total cost of an investment consists of the cost of fund management, fund administration and fees for buying and selling fund units. The SmartFlex pension plan which involves investing part of savings capital in equity investments is characterized by comparatively low investment costs.

The general principle for long-term saving is that regular payments and consistent savings discipline are the nuts and bolts for sustainable and continuous capital accumulation. But regular contributions into a return-oriented pension plan also make sense with a view to investing on the stock market. Because those who contribute regularly benefit from being able to buy when prices are low when share prices fall. Here the experts also talk about the average price method in this regard.

Insurance companies offer various protection instruments for capital accumulation with shares. The SmartFlex pension plan, for example, has an option to pay one part of the monthly savings contributions into safety capital, which earns interest at a fixed rate, and the other part into return-oriented capital, which is invested on the stock market to generate returns. The allocation formula of the monthly contributions can be flexibly adjusted at any time. Additionally, SmartFlex offers more safety options, such as expiration management, manual reallocation or protection of returns. Find out more here on the SmartFlex pension plan.

One look at prices and performance over the past 25 years shows that investments in shares have fared considerably better than bonds or savings accounts, despite various crises such as the dotcom bubble around the turn of the new millennium, 9/11 or the 2008 financial crisis. This is the reason why experts agree that broadly diversified equity investments, combined with other instruments, are ideal tools for building up private pension provision.

No. Private individuals do not have to pay tax on price gains or capital gains in Switzerland. Profits generated from the sale of shares are therefore not subject to income tax. However, the securities in question are subject to wealth tax and must be declared accordingly on your tax return. Income from share dividends and interest plus similar income is also taxable.

AXA invests solely in investment funds with broadly diversified shares and pays particular attention to sustainable investments. It excludes 600 companies in sectors such as tobacco, arms, coal, palm oil, oil sands and others. No investments are made in these companies. The SmartFlex pension plan also gives customers the option of making their own investment choices by choosing an investment topic: “Sustainability”, “Switzerland”, “Future trends” or “Global”. You can find more information about this here.

The purpose of Pillar 1 is to secure livelihood in retirement, in the event of disability and incapacity to work, or after a death.

Pillar 2 includes occupational pensions, occupational accident insurance, daily sickness benefits insurance, and the vested benefits institutions. It's intended to enable people to maintain the standard of living they're accustomed to after retirement.

By making voluntary payments into a tied (Pillar 3a) or flexible (Pillar 3b) pension, you can close any income gaps from Pillars 1 and 2 of the Swiss pension system to the fullest extent possible.

Do you have any questions, or would you like a pension consultation? We are always there for you!