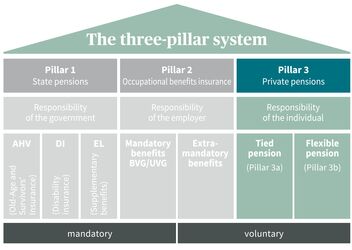

Flexible pension provision (Pillar 3b)

Pillar 3b flexible pension provision (also known as non-tied retirement provision) is a private pension solution that is a good way to close a pension gap, because the pension from the pension fund is often insufficient to continue the person’s accustomed lifestyle after retirement. It is not subject to government requirements regarding amounts paid in, availability or timing of disbursement. But what many people do not know is that tax savings are also possible with a 3b pension solution, subject to certain conditions.

Pillar 3b flexible pension products are often integrated as components of complete solutions, like life insurance policies, investment funds, accounts, securities, residential property, collections of valuable items, etc.

Saving tax with Pillar 3b

Flexible pension provision also offers attractive possibilities for saving on taxes. For example, tax exemption applies to periodically financed endowment life policies and single premiums, if certain conditions are met. Unlike retirement pensions disbursed from Pillar 3 capital, which are 100% taxable, pension payments from Pillar 3b flexible pension provision are only 40% taxable.

Availability and disbursement

Unlike Pillar 3a tied pension provision, which can only be paid out subject to certain conditions, no legal restrictions apply to disbursements from Pillar 3b flexible pension provision. It is only necessary to comply with the minimum contractual terms or the contract term as agreed.