Old-Age and Survivors' Insurance (AHV)

Old-Age and Survivors' Insurance is Switzerland’s mandatory state pension insurance. It secures a person’s financial livelihood in old age, and pays surviving dependants' pensions to widows and widowers following a death.

Contribution obligation

As a general rule, all employed persons domiciled in Switzerland must pay AHV contributions. Contributions are deducted from the salary by the employer, and are used directly to pay for pensions currently in progress, according to the pay-as-you-go principle. Employers and employees pay equal shares of the amounts to be transferred. The obligation to make contributions to OPA begins when you turn 17 and ends when you (both men and women) reach the reference age (formerly: normal retirement age) of 65.

Contribution period and contribution gaps

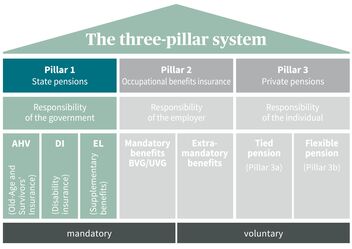

Each missing contribution year results in a reduction of the pension payable to the insured person in old age. This makes it important to close pension gaps of this sort within 5 years at most. The full contribution period lasts for 44 years with a reference age (formerly: normal retirement age) of 65 for both men and women. Beneficiaries can pay contribution gaps back into the AHV fund within the five-year period after such gaps arise. Alternatively, of course, they can opt for voluntary private pension provision, for example by paying into a Pillar 3a or 3b account to provide security in old age.

Personal entitlement to a pension

Entitlement to a pension from Pillar 1 is calculated on the basis of the person's individual account (IC). This account is used to calculate and record the personal income earned by an individual. Single persons receive an individual pension that, by law, must not be more than double the minimum retirement/disability pension per year. The amount of an AHV pension for married couples is calculated as half the total of both their incomes. If the total pension disbursed is 150% above the maximum pension permitted by law, the individual pensions are reduced. This fact is often forgotten when planning retirement provision, and it can indirectly lead to dangerous loss of income in old age.

Education and care credits

Anyone looking after children below the age of 16 during the period of their life when they must pay contributions will benefit from additional education credits. These are offset against the relevant annual income for the AHV pension, and they result in higher annual AHV disbursements provided that the maximum retirement/disability pension is not exceeded. Care credits can also be claimed in the same way, for example in connection with looking after relatives in need of care.

Income splitting

Income splitting means that the incomes earned by two marriage partners during the years of the marriage are split into equal portions. For this purpose, 50% of each of the two incomes is credited to the other partner’s AHV account. This regulation, introduced in 1997, applies to married and divorced couples, widows and widowers.

Retirement date

Regular retirement for both men and women is age 65. There are special provisions regarding the reference age for women who were born between 1961 and 1963 (transitional age group).

Insured persons have flexible options for withdrawing their OASI pension. Retirees can draw a monthly pension between the ages of 63 and 70, while women in the transitional age group can start drawing a pension at age 62. Early retirement leads to reductions in the pension disbursed, whereas deferral is rewarded with a higher pension. Applications must be submitted both for taking early retirement and for deferring a pension.

Benefits at retirement age

Depending on the average income earned and the resultant AHV deductions, the normal full pension is at least CHF 1,260 and at most CHF 2,520 (as at 2026). If a person is simultaneously entitled to draw a widow's / widower's pension, the higher pension is paid out. If persons charged with childcare are entitled to draw a child's pension, this will also increase the AHV pension that is disbursed, as long as the total amount does not exceed the maximum retirement/disability pension per year for single persons. A maximum of one and one half times the joint retirement income of the wife and husband applies to marriage partners.

Benefits in a death case

Surviving dependants' pensions are intended to prevent financial hardship due to loss of income when a marriage partner or parent dies. Marriage partners and divorced persons are entitled to widow's / widower's pensions, but the qualifying conditions for wives differ from those for husbands and divorced persons. Survivors' Insurance has been part of the AHV (Old-Age and Survivors' Insurance) since it was introduced in 1948.