Lots of Swiss people have amassed a small fortune in the form of an occupational pension. As retirement draws nearer, you need to think about how you want your retirement savings paid out. You can choose between a regular annuity and a one-time lump sum. It's an important decision that will affect your financial situation over the long term after you retire.

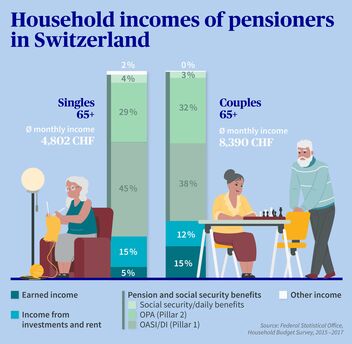

Funding your retirement is a complex topic, and there are a variety of factors you need to consider. Fundamental decisions you make before retiring can't be undone after the fact. That's why it's important to think about these questions as early as possible so you have plenty of time to work out the answers: How much will you need to live on when you're retired? How much money can you expect to get from your state pension, and how much from your occupational benefits? Will you have any other income, e.g. from a voluntary Pillar 3a or 3b account? Will you be responsible for supporting a partner or child? Is there something you really want to do, like take an extended trip abroad or make a gift to your children?

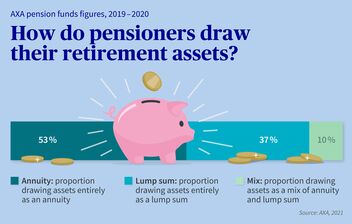

What's more important to you: a steady income or financial flexibility? You need to answer this question before you can determine the best way to draw your occupational benefits, i.e. as a lifelong annuity paid every month, a one-time lump sum, or a mix of the two. The best solution will depend on your personal circumstances. Our guide will help you to work out quickly and easily which option best suits your needs. We recommend seeking expert advice to analyze your situation in detail, including legal and tax aspects.

The pension system in Switzerland is based on three pillars: state, occupational and individual retirement accounts. Throughout your working life, part of your salary is automatically deducted and paid into a company pension, also known as occupational benefits insurance or Pillar 2. You can only access your retirement savings before retirement if you buy a home, become self-employed or leave Switzerland. Ideally, though, all the money you pay into your Pillar 2 pension fund should stay there to complement your state pension (Pillar 1) so that you can maintain the standard of living you're used to after retiring. Most people have several hundred thousand francs in their pension fund by the time they retire. That money belongs to them. They have an important decision to make: should it be paid out monthly as a lifelong annuity or all at once as a lump sum? Both options have their advantages and disadvantages. A mix of annuity and lump sum is also possible.

Pros: The main argument in favor of a monthly annuity is financial security. You're guaranteed a regular, lifelong income. When you die, your spouse will receive a widow's or widower's pension. Children in full-time education will receive a child's pension. An annuity is also the simplest option because you don't need any financial or investment know-how – the pension fund takes care of your retirement savings for you.

Cons: In contrast to a lump-sum withdrawal, a lifelong pension is affected by the conversion rate. Together with the accumulated retirement savings, the conversion rate defines the amount of pension earned. Inflation should also be kept in mind because it decreases buying power. On top of this, your annuity will be taxed in full as income. And if you die early and do not leave behind a spouse or civil partner, the remainder of your retirement savings goes to the pension fund, not to your heirs.

Pros: If you have your retirement savings paid out as a lump sum rather than an annuity, you enjoy total flexibility. For example, you could invest the money yourself, pay off your mortgage or make some long-held wishes come true. All of what's left after you die goes to your heirs. You'll also save on taxes over the long term: when they're paid out, your retirement savings are taxed separately from any other income at a lower rate (usually 5-15%). Depending on how you invest, you could compensate for inflation by generating higher returns.

Cons: The biggest disadvantage of a lump sum compared with an annuity is that you bear all the risks yourself. The stability of the invested capital and the resulting amount of income generated depend on which investment strategy you choose. And you don't know how many years your savings will have to last. You might get your calculations wrong and/or expect too much when it comes to returns. You'll need a little courage to take risks, time to plan, and an eye for a good investment – or a good advisor.

Smaller amounts of retirement assets are often drawn as a lump sum, medium-sized amounts as an annuity, and larger amounts as a mix of the two. Every pension fund is required by law to allow its members to draw at least 25% of their mandatory benefits as a lump sum, but many are prepared to pay out as much as half or even all of them as a lump sum. By mixing an annuity and a lump sum, you combine their respective opportunities and risks. The lump sum can go toward realizing your dreams, while the regular annuity provides you with a fixed income. Most pension funds leave it up to you how you draw your pension. There are various strategies for deciding what's right for you.

Example 1: Mr. B wants to spend the winter in Southern Europe after he retires. That will increase his living costs. He generally needs CHF 2,000 a month – CHF 24,000 a year – from Pillar 2 to live on. A conversion rate of 5% would mean that he needs savings of CHF 480,000. However, Mr. B actually has more than CHF 600,000 in his pension, so he can afford to take CHF 100,000 as a lump sum.

Example 2: Mr. K has retirement assets of CHF 500,000, and Mrs. K has CHF 300,000. They would like to use some of this money to pay off their mortgage. Mr. K's pension fund has the better conversion rate, so he draws his CHF 500,000 as an annuity, while Mrs. K draws her CHF 300,000 as a lump sum. If Mr. K dies before Mrs. K, she'll continue to receive around 60% of her husband's pension as a widow's pension.

What you decide before your retirement will have a significant influence on the rest of your life after it. However, there are plenty of reasons to view retirement planning as a good thing rather than a chore. Dare to dream, make plans, imagine the freedom you'll enjoy. As soon as you have an idea of what's important to you in financial terms, you can work out specific future plans based on your priorities. Our guide will help you to get started by providing an overview of your situation. If you start thinking about your pension between the ages of 50 and 55, you'll have enough time to prepare and look forward to the third age.