Retirement provision tips for women

Many years of caring for children or part-time work after pregnancy: Women with children often face special challenges when it comes to retirement provision. Five practical tips on how you can minimize income gaps and optimize your private and occupational retirement provision.

Numbers never lie. And when it comes to retirement provision, the picture for women still looks bleak: On average, women receive around one third less retirement from Pillar 1 (AHV) and Pillar 2 (BVG) than men. Part-time work and a lower income are to blame. The lion’s share of this so-called pension-gender gap occurs in the occupational benefits insurance. In addition, women generally also have less money, assets, and income on a private level. That’s why they are less likely to save with Pillar 3.

However, many are aware of the impending retirement income gap: Around one third of women in Switzerland are concerned about whether they will have enough money after retirement. We found this out in a representative survey of 1,000 Swiss people in 2024.

First tip: Close your pension gaps

Regardless of whether you take a longer baby break after the birth of your child or children or decide to work part-time: This is how gaps in your retirement provision occur. This means that you will save less for your retirement and draw a lower pension later on.

That’s why you should first get an overview of your previous payments into Pillars 1 and 2. For the maximum AHV pension of CHF 2,520 per month (as of 2026), you need an average annual income of at least CHF 90,720. Many people working part-time fail to achieve this level of income.

Contribution gaps have an even more detrimental effect: Every missing contribution year leads to a further pension cut of 2.3%. To avoid this, you must take the initiative yourself when you take a break from work: Voluntarily pay the minimum annual contribution of currently CHF 530 (as of 2026) into the AHV. You can request a statement of your personal AHV account from the compensation office. Payment gaps can be closed within five years within five years by paying the minimum contribution in arrears.

Consideration of individual circumstances

When it comes to pension gaps, the individual situation of a person should always be taken into account. Whether married, with or without children – there are various regulations and options. For example, there are education and care credits or special regulations for married people who are not gainfully employed. Contributions from spouses who are not gainfully employed are deemed to have been paid if the partner pays contributions amounting to twice the minimum contribution in the course of gainful employment. Employer contributions are also included in this calculation.

Crediting of adolescent years

Employed persons start paying AHV contributions from January 1 following their 17th birthday. For those not gainfully employed, the contribution obligation begins on January 1 following their 20th birthday. The three years in between, from 17 to 20, are referred to as adolescent years.

If there are any contribution gaps at a later date, these can be fully or partially covered by the adolescent years.

Second tip: Pay into your Pillar 3 account

Pillar 3a is available to close gaps that arise during family time. Female employees with a pension fund may pay in a maximum of CHF 7,258 (as of 2026). For self-employed women without a pension fund, the annual payment is limited to 20% of net income, up to a maximum of CHF 36,288 (as of 2026). You can deduct the amount paid in from your taxes. With Pillar 3a, you also have the option of hedging against the financial risks of incapacity to work or death.

Incidentally: You can also pay into Pillar 3 even if you are not employed – in this case into Pillar 3b.

Third tip: Protect yourself against accident or illness

Accidents can happen anywhere, whether at home or during leisure activities. And even a strong immune system does not protect against all illnesses. If a family member is absent, this can lead to considerable financial losses. At the same time, important household chores and care tasks are left undone. With 911,000 occupational and leisure-time accidents (in German) recorded in 2022, there is a statistical probability of more than 10% that you will be affected by such an event.

Options for financial protection

There are several ways to minimize these financial risks:

- With disability insurance, you will receive a pension in the event of disability.

- Supplementary health insurance can pay contributions for household help or childcare during an illness.

- Term life insurance protects your loved ones from financial hardship in the event of your death.

These types of additional coverage should always be adjusted to the income of your partner and your individual situation. It’s worthwhile to obtain personal advice.

It’s important to remember that women who are not in gainful employment or work less than eight hours a week are not insured against non-occupational accidents. They must therefore insure themselves against non-occupational accidents under mandatory health insurance. If they then return to work for an employer in Switzerland for at least eight hours a week, they are again fully insured under the UVG and can have the accident coverage canceled by their health insurer.

Fourth tip: Check the options in your occupational benefits fund regulations

In principle, the same coordination deduction applies to part-time employees as to full-time employees. Unless your employer has provided for a lower coordination deduction for part-time employees in the pension fund regulations.

Let’s assume that you return to your job with a part-time workload of 60%. The coordination deduction for an annual salary of CHF 80,000 (100% workload) is CHF 26,460 (as of 2026), i.e. almost one third. With a 60% workload, it is already more than half. If the pension fund regulations provide for a reduced coordination deduction, your deduction will be adjusted to CHF 15,876. This means your insured salary is higher and you pay significantly more money into the pension fund even with a lower annual salary. The outcome is that you save more for retirement. This won't close your payment gap, but at least it won't widen it any further.

Definitely use your next job interview for part-time employment as an opportunity to discuss the issue of coordination deduction.

What is the coordination deduction?

The coordination deduction is a fixed deduction from the gross annual salary to determine how much income should be insured with the pension fund. In this way, the legislator aims to prevent double insurance of salary components in Pillars 1 and 2. In other words, the coordination deduction ensures that only the part of the salary that is not already covered by AHV/IV is insured. In 2026, this is CHF 26,460, which corresponds to 7/8 of the maximum AHV pension.

Example: You have a gross annual salary of CHF 80,000. After the coordination deduction, your income insured under Pillar 2 is still CHF 53,540.

Fifth tip: Invest your retirement capital

In times of low interest rates on savings accounts or traditional 3a accounts, it is worth investing your private retirement provision in the financial markets. This is because investment funds with a high proportion of equities offer significantly higher potential returns. Especially if you have a long investment horizon.

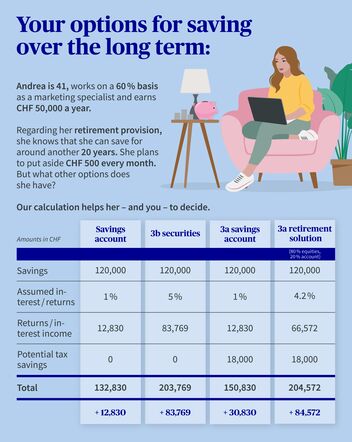

An example based on current figures: Andrea is 41, works on a 60% basis as a marketing specialist, and earns CHF 50,000 a year. Regarding her retirement provision, she knows that she can save for around another 20 years. She plans to put aside CHF 500 every month. But what other options does she have? With a savings account and 1% interest, she would have CHF 132,830 for her retirement after 20 years. With a 3a pension solution from AXA, she benefits from a return of 4.2% and saves an additional CHF 18,000 in taxes. Her capital thus grows to CHF 204,572.

The earlier you start to invest, the better your return: Women who save for another 20 years or more until retirement can achieve an additional amount of over CHF 70,000. Thanks to Pillar 3 with a securities component, pension gaps can therefore be easily reduced. And time is on your side.

Source: Own depiction

In conclusion: Having a family and saving for retirement are not mutually exclusive.

Taking plenty of time for family and children is important. But it is just as important to take steps at an early stage to prevent poverty in old age. Use your options to save in a Pillar 3a solution and a pension fund to provide for your retirement and close any income gaps. Also check what impact a securities solution would have on your retirement savings – especially if you calculate with a longer investment horizon.