Retirement marks an important turning point in life, especially for women. This is because women often have gaps in their careers due to the responsibilities of raising and caring for children, which has an impact on their retirement provision.

The transition from working life to retirement involves both financial and social changes. In Switzerland, there are specific regulations and special features that women should take into account when planning their retirement. This gives them the best possible start to retirement.

Until 2024, the statutory retirement age for women was 64 years, while men could retire at 65. This means that women are generally fully entitled to Old-Age and Survivors’ Insurance (AHV) from the age of 64. Since 2024 however, the age limit of 65 years has also applied to women – and this with important transitional regulations.

The pension system in Switzerland is regularly adjusted to ensure its financial stability and take account of demographic changes. One of the most important recent reforms is the OASI 21 reform, which was passed by Parliament in 2022 and has been in force since 2024. This reform provides for a gradual increase in the retirement age for women to 65 years. The aim of this adjustment is to promote equality between men and women and to stabilize OASI financially.

The reference age is a key term in the Swiss pension system. For women, it is currently 65 years. This age serves as the basis for calculating the old-age pension. Early retirement before this reference age is possible, but this will result in pension reductions to compensate for the longer drawing period.

Women born up to inclusive 1960 can regularly retire at age 64. For women nearing retirement age, the reform is being implemented gradually:

These regulations are accompanied by further provisions concerning persons born in 1961 to 1970. There are compensatory measures for women of these age groups, as they may experience disadvantages as a result of later retirement age.

For example, if you withdraw your pension in advance, the reductions would be smaller, and that would be staggered according to your income. If you do not draw your pension early but work until full retirement age, you will receive a supplement. Depending on your income, this amounts to up to CHF 160 per month.

In Switzerland, there is no law that requires a person to work until the age of 70. However, there are ways to work longer:

The amount of the OASI pension is determined by various factors:

With the Swiss Compensation Office's online pension estimate, insureds can calculate an estimate of their retirement provision online.

Retirement for women aged 65 and over will change life plans. In Switzerland, however, it is possible to draw your OASI pension early if you do not want to work until you are 65.

If you would like to start your retirement early, you should consider the possible financial implications beforehand. On the one hand, you can only start your pension from the age of 63 (an exception of 62 applies to the transitional generations).

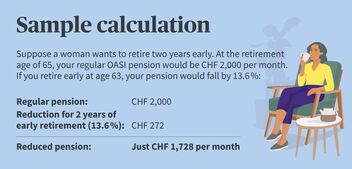

Secondly, deductions are applied to the OASI pension for each year of retirement before the statutory retirement age. These deductions amount to 6.8% per year of early retirement.

Women should consider private pension to strengthen their financial security in retirement. Pillar 3a is a voluntary form of pension provision that was specially developed to supplement state and occupational benefits insurance. A key advantage of Pillar 3a is the tax incentives: Contributions can be deducted from taxable income, resulting in direct tax savings.

Supplementary benefits (EL) are relevant for women with a low OASI pension in order to secure the minimum standard of living. Women who live in Switzerland and receive an OASI or disability pension are eligible. The amount of extra income is calculated by calculating the difference between recognized expenses (e.g. rental costs, health insurance premiums, and living expenses) and effective income (e.g. OASI pensions and assets).