Cost-average effect: invest steadily and benefit

I’d like to invest money, but when? What if I pick the wrong time and my investments are particularly expensive? This is precisely why it’s worthwhile benefiting from the cost-average effect.

The subject of investing seems daunting for many people – technical terms here, complex market dynamics and daunting examples there, and anyway, it’s all too risky! However, it’s actually worthwhile for savers to invest their money to counteract inflation and make more out of their assets. It’s not as complicated as it often seems.

How do I become an investor?

Becoming an investor isn’t hard. After all, there are now many options for not just letting your assets languish in your account, but also for getting them to work with little effort.

Banks and insurance companies offer fund solutions or ETFs that make it easy to enter the equity markets without having to follow market developments on a daily basis or constantly reallocate money.

Advice is particularly important: a good advisor looks at your individual circumstances, financial options, risk tolerance and capacity, draws up an investor profile based on this and suggests suitable investment options. A basic understanding of financial markets is always helpful. You can also obtain information on equities, bonds, diversification & etc. from your advisor or online platforms.

Invest with Pillar 3 for the first time

- The money in Pillar 3a can only be withdrawn under very specific conditions – it is usually held in an account for several decades.

- With Pillar 3a, you can benefit from the compound interest effect and return opportunities. Don’t worry, this is also very conservative.

Do I have to invest a large sum?

“Investing is only for people who already have a great deal of money!” This misconception still seems to persist, but it’s dangerous as well as false.

This is because those who aren’t particularly wealthy would do well to let their money work for them. However, this only applies to assets that investors can do without for a while (ideally for as long as possible). Current expenses, provisions for taxes, vacations, health insurance premiums and unexpected emergencies, or savings for big dreams such as training or a round-the-world trip should always take priority before investing. It’s always important to have a solid amount of spare cash.

What’s left over can easily be invested, even small amounts. For example, there are savings plans where small amounts can be paid in on a regular basis. One-off investments are also possible at most banks and insurance companies for as little as a few thousand francs.

What if I invest at the wrong time?

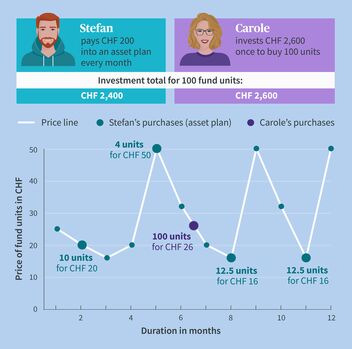

The stock markets are constantly fluctuating – sometimes they go up, sometimes they go down. How do you find the right time to start? There’s no easy answer. After all, even experts are unable to predict how the markets will perform. The fact is that investing in the long term minimizes the risk of choosing to start at the wrong time – this is because historically, stock markets have tended to rise in the long term. And it’s also possible to invest regularly rather than on a one-off basis. With an asset plan or a fund savings plan, investors can pay a fixed amount into a fund on a regular basis (e.g. monthly). By doing so, they benefit from the cost-average effect. This is how it works:

- Stefan pays CHF 200 into an asset plan every month

- In months when the markets are high, he gets fewer equity units for his CHF 200 than in months when the markets (= prices) are low.

- He pays an average of CHF 2,400 per 100 fund units in a year because he was able to benefit from low prices this year

- Carole invests CHF 2,600 once to buy 100 fund units at a time when the markets are high

In this example, Stefan benefits from the cost-average effect: he gets more for his money by regularly investing smaller amounts, thereby minimizing the risk of investing at the wrong time.