Inheriting in Switzerland: Inheritance law, order of succession and useful information

Over the course of their lives, almost everyone faces the issue of inheritance. Read this article to find out what you need to know and bear in mind if you are about to inherit or plan to inherit.

It is estimated that 88 billion francs were inherited in 2022. Nonetheless, families rarely talk about the topic – as our Pensions Study (in German) from 2023 shows. Many people are suddenly faced with a multitude of questions and an increase in wealth. You should therefore deal with it at an early stage and, in the event of an inheritance, plan what you would like to do with it – including over the long term.

Inheriting in Switzerland: What the law stipulates

In Switzerland, inheritance law governs who inherits in the event of death and how the estate is divided among the heirs. While you’re alive, you can set up an inheritance contract or a will to specify who should receive which assets. However, the law sets limits. Our expert also looks into the legal aspects of inheritance in the blog “Wills, inheritance, funeral: Answers to the most important legal questions.”

Key terms in inheritance law explained in a nutshell

Anyone who deals with the subject of “inheritance” comes across a variety of legal concepts. We explain the most important ones here:

- Testator: deceased person whose assets are inherited

- Estate: Assets less debts of the testator

- Heir: Person who receives part of the testator’s estate.

Inheritance and entitlement to compulsory portions

Compulsory entitlement of spouses and children

A certain group of persons is entitled to a share of the inheritance. This portion is defined by law and depends on the composition of the inheritance. The mandatory portion belongs to the spouse / registered partner and descendants. The mandatory portion amounts to 50 percent of the statutory portion of the inheritance.

The partially revised inheritance law came into force in January 2023. These are the main changes:

- The compulsory portion has been reduced from 75 percent to 50 percent.

- Parents are no longer entitled to a compulsory share.

- The assets from Pillar 3a do not belong to the estate.

- Once an inheritance contract has been concluded, gifting is no longer permitted.

- Married couples can exclude themselves from the inheritance even before a divorce decree is issued.

Statutory order of succession and share of inheritance in Switzerland

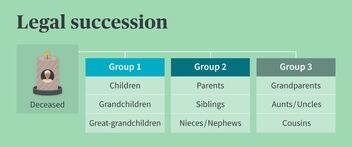

The degree of relationship determines the legal order of succession. While the spouse and the registered partner have a special position and always inherit, the other persons entitled to inherit are divided into three groups

- Group 1: Children and their descendants

- Group 2: Parents and their descendants

- Group 3: Grandparents and their descendants

The share of inheritance determines the extent of the different inheritance portions. It not only determines who inherits, but also how much is inherited. If nothing has been stipulated in a will or inheritance contract in advance, the statutory order of succession and share of inheritance apply. There are 4 basic rules to be observed:

- Rule: The proximity of the group is decisive. The group that is the closest to the deceased always inherits.

- Rule: Within the group, the top generation is entitled to inherit and excludes the next generation.

- Rule: If the top generation is deceased, their direct descendants are entitled to inherit.

- Rule: If there are no persons in one group, the next group always inherits. For example, if there are no descendants (1st group), the parents (2nd group) are the legal heirs.

Two examples illustrate these rules:

Scenario 1: On death, the spouse and a daughter are among the survivors. The son, who is already deceased, has two children. The inheritance is distributed as follows: Wife: 50 percent, daughter: 25 percent, grandchild 1 and grandchild 2: 12.5 percent each

Scenario 2: On death: The testator has no children and her spouse has already died. She is survived by a father and two siblings. The inheritance is distributed as follows: Father: 50 percent, siblings: 25 percent each

The freely disposable inheritance portion in Switzerland

Testators have the option of structuring their estate according to their own wishes. The entire inheritance less the mandatory portion is called the freely disposable portion. A will or inheritance contract can determine how the assets of this portion are to be distributed.

Wills and inheritance contract explained:

Will: With a will (also a last will and testamentary disposition on death), the testator can determine who should inherit which assets after death. This makes it possible to deviate from the statutory order of succession, taking into account the compulsory portion. Certain formal requirements must be observed when drawing up a will.

Inheritance contract: An inheritance contract is concluded between the testator and all entitled heirs. This means that an inheritance contract is a two-way inheritance transaction that can only be changed with the consent of all parties. The formal requirements of the inheritance contract are stricter than for a will. Unlike a will, a waiver of the compulsory portion can also be agreed in the inheritance contract if the heirs who are entitled to a compulsory portion waive this in the contract. Once the inheritance contract has been concluded, gifting is no longer permitted

Planning your inheritance in good time

An inheritance changes many things from one day to the next. This is why you should deal with the subject at an early stage. Ideally, you should discuss this with your family and the persons entitled to inherit. In addition to the potential for conflict, inheritance also has tax consequences, which vary from canton to canton.

For this reason, it’s best to plan the estate as a whole and consider your options:

- Does a will or inheritance contract make sense?

- Is it worth passing on part of the assets early?

Our tip: Talk to the experts to analyze the current situation regarding your needs to find the best possible solution.

Check options for an inheritance advance

Swiss people usually only inherit from the age of 60. A look at the distribution of wealth shows that many people already have a great deal of wealth at this time. On the other hand, wealth is often in short supply when people are young. It may therefore be worth considering an inheritance advance in order to help your descendants financially fulfill their life dreams. You can find out more about this in the article “Inheritance advance in Switzerland: Pass on assets while you are alive.”

Sudden inheritance – what to do with it?

Your financial situation changes when you inherit. Accordingly, you should also review your financial planning as a whole. For example, ask yourself the following questions:

- What is the status of my pension provision? Do I have any gaps that I should close?

- What are my dreams and goals for the future for which I need financial resources?

- What do I need today and what can I put aside?

Especially when it comes to issues that affect the future, it is advisable to look at various investment options in order to make more out of the money. We will be happy to advise you.