Frozen water pipes: Here’s how to avoid frost damage

The major cold spell in winter leaves its mark on buildings too. Water pipes can freeze and burst in unheated rooms or empty holiday homes. The effects only become apparent in spring when the defective pipes thaw and water escapes unimpeded. What insurance covers consequential costs, and what can you do to avoid frost damage before the winter frost arrives?

If the temperature in unused buildings is below zero for a long time, things happen quickly: The water pipes freeze and the volume inside them increases - the pipes often cannot withstand this pressure and burst. Most frost damage goes unnoticed. The rude awakening only occurs in the spring when the ice melts again and the water escapes through the leaks. Buildings such as holiday homes or holiday apartments in particular that are unoccupied for a long time as well as storage rooms and basements are affected by frost damage.

What do I do in the event of damage/loss?

Homeowners should never try and thaw frozen pipes themselves. If the pipe is actually damaged, the water will otherwise escape freely and cause more damage. Turn off the water supply and contact your insurance company. They can advise you what to do next or arrange for a specialist such as a plumber.

Which buildings insurance pays for frost damage?

Frost damage is not caused by natural hazards such as storm, flooding or rockfall, therefore cantonal buildings insurance does not pay in this case. It is covered by water damage insurance for buildings which can be taken out voluntarily. It covers the cost of thawing and repairing damaged water pipes, but also other damage which is normally much more extensive, i.e. the damage caused to the building by the leaking water.

If furniture, carpets or other furnishings are damaged by a leak, this is covered by household contents insurance. It covers the repair or replacement of damaged items as well as the cost of removing and disposing of the damaged goods. If the water damage is so extensive that the rooms are no longer habitable, the households contents insurance will even cover the cost of temporary accommodation.

Tips: How can I avoid frost damage?

Most frost and late frost damage is avoidable. Even if you’re well insured, you must take certain steps and comply with due diligence and obligation duties. Here are our tips:

- Keep the heating at a minimum level or drain the system: Even for properties that are temporarily not being used or are unoccupied, the heating should never be switched off completely. To avoid frost damage, it's not enough to set it to frost protection mode, as this protects the radiators but not the pipes. Set the heating to at least level 1. If the property is unused for a long time, the pipes, fittings and appliances should be drained.

- Frost protection solutions: There are special frost protection solutions available to protect exposed pipes against sub-zero temperatures. For instance, you can cover the pipes with thermal insulation material. If the pipes are in an unheated room, trace heating can help - this is automatically activated in sub-zero temperatures or if the temperature falls below a certain level, thereby providing very solid protection against frozen water pipes.

- Turn the water off: Even if the unused building is heated, you should turn off the water supply at the water pipe in the basement. Then turn all taps on to empty any remaining water. If the heating breaks down, this will prevent water escaping and freezing.

- Garden pipes, appliances, swimming pools and water pumps: Empty garden pipes and use frost-resistant water pipes in outdoor areas. Don’t forget devices and appliances such as hot tubs or pressure-washers which are operated with water. Store these in frost-resistant places or make sure that you drain them completely to avoid frost damage.

- What to keep an eye on: Even for holiday apartments and holiday homes, but also for other properties that are unoccupied or only partially occupied, it can be worthwhile installing electronic monitoring of the heating system and heating valves. Electronic freeze protection cables are also useful.

- For tenants: Even if the apartment is unoccupied for a long time, all rooms must still be heated. The landlord should be informed of the absence.

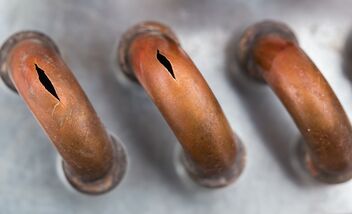

Cracks in copper pipes caused by frost.

Well insured as a tenant

If you as a tenant cause frost damage or share the responsibility, personal liability insurance covers the financial consequences. For example, if you breach your maintenance duty or do not observe your duty of care.

Frost damage insurance for companies

Comprehensive corporate property insurance is normally sufficient to be protected against frost damage too. Apart from fire, damage caused by natural forces, theft and water damage, corporate property insurance also covers loss of earnings. If expensive machinery is exposed to the cold in winter, it makes sense to take out additional engineering insurance.

Other insurance against damage caused by cold weather

Extreme cold not only affects water pipes but can also cause other damage. The following are options for insuring against this:

- Technical systems: Whenever there is a cold spell, machinery can also be affected, particularly at companies. Here it makes sense to take out engineering insurance.

- Plants: Unfortunately there is no insurance protection for private garden plants such as rosebushes or shrubs.

- Heritage crops: Frost damage to heritage crops such as fruit trees, berries and vines can be insured through Swiss hail insurance.