Buying equities – is it worth it?

Anyone who buys equities is taking a high risk. This misconception is still widespread among many investors, especially inexperienced ones. Here we explain why this is not true.

First things first: Anyone who invests money will always have to take a certain amount of risk. However, investors can also benefit from significantly higher potential returns than savers who simply leave their money in a savings account. Equity investments offer a particularly high prospect of returns, especially compared to more conservative investments such as bonds.

Why invest in equities at all?

Everyone is talking about it: Inflation. Slowly but surely, it is causing the money in savings accounts to lose value. Savers can therefore afford less and less, even though their assets are safe in an account and earn minimal interest. So if you want to make more of your own assets, there is no way around investing at least part of them in investment products – be it funds, ETFs, equities, bonds, or precious metals. This is the only way to not only compensate for inflation, but also to make some profit.

The most important rules for investing in equities

“If you buy equities, you run the risk of losing everything” – “To make a profit at all, you have to pursue a risky strategy” – “If you don't know the financial markets in detail, you shouldn't invest.” Newcomers to investing often hear advice like this. This doesn't necessarily encourage people to get to grips with the topic of “investing money.” But it's not all that complicated. If you follow a few simple rules you don't have to be afraid of buying equities. The following are particularly important:

- Risk profile: Only take as much risk as you can afford

- Diversification: Don't invest all your money in just a few companies

- Investment horizon: The longer the horizon, the lower the risk

If you have no financial knowledge, it is a good idea to seek comprehensive advice. Investment experts and financial advisors at banks and insurance companies can help you to define your own risk profile and can provide precise advice to investors who may be looking to buy equities for the first time.

Buying equities and investing for the long term: Increase returns

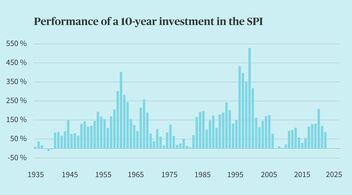

Investors with a long-term investment horizon, i.e. who can remain invested for a minimum of five, or even better ten or more years, have a good chance of achieving returns. Historically, the value of the stock markets has risen. In fact, the stock market can fluctuate very strongly in the short term – both upwards and downwards. However, these fluctuations can be balanced out well if you plan for the long term. For example, if you invest in the SPI (Swiss Performance Index) for ten years, you will not only compensate for the poorer performance years, but historically will also make a considerable profit in the vast majority of cases during these 10-year periods.

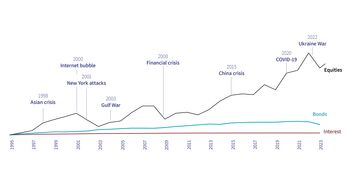

Historical development says: The stock markets are rising

A look at the global historical performance of equities compared to bonds is also revealing: After all, equities manage to overcome even major market crises – such as the 2008 financial crisis or the COVID-19 pandemic. Share prices often even rise disproportionately after times of crisis. Important here too: Long-term thinking pays off (in the truest sense of the word).

How can I buy equities in Switzerland?

Anyone who decides to invest money in equities is already faced with the next question: How does it all actually work? Buying individual stocks directly is not a good solution for most investors. After all, it is hardly possible to achieve the necessary diversification in this way, so the risk would only lie in a few individual stocks. It makes more sense to invest your assets in an equity fund or an ETF. This spreads the invested capital across many different individual securities, thereby reducing the risk. There are many ways to invest in equities via funds or ETFs. Here too, advisors can help you find the best solution. And: If you're not quite ready to jump into the world of equities with both feet, you can also become an investor with smaller amounts and initially invest only a portion of your own assets.