Wills, inheritance, funerals: Answers to frequently asked legal questions

An inheritance often entails many legal questions. How do I make sure my will is valid? Am I free to decide who inherits my assets? Under what circumstances can I turn down an inheritance? And what happens to all the household effects no-one wants? ? Moreover, with the revision of inheritance law, which will come into effect on January 1, 2023, major changes will apply to Swiss inheritance law for the first time in 100 years.

Who is entitled to inherit? What portions are assigned to the individual heirs by law?

First in line are the surviving spouse or registered partner and their heirs: children, grandchildren, and great-grandchildren.

If the deceased had no spouse or registered partner, and had no children either, the parents or their heirs will inherit – the sister of the deceased, for example.

If there are no parents and/or their children, then the grandparents and/or their children will inherit.

If the deceased does not have any heirs, the inheritance goes to the canton in which the deceased last resided – or to the municipality that is legally entitled under the legislation of that canton.

What's the mandatory portion all about?

The mandatory portion is a guaranteed share of the inheritance for the heirs, parents, spouse, or registered partner.

The free portion is the share of inheritance assets that is not subject to the compulsory portion obligation and thus can be passed down according to your individual wishes.

In your will, you can decide who will receive how much and, in doing so, deviate from the legally stipulated inheritance portions. However, the law restricts your options through so-called mandatory portions. In this way, the law sets out that certain heirs must have a claim to a certain portion of the estate. These mandatory portions must be taken into account in your estate planning. You can freely decide about the remainder of your estate: That portion is the so-called free share.

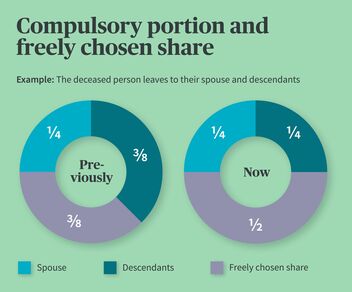

What changes will the revision to inheritance law, which comes into effect in 2023, entail with regard to the mandatory portions?

- Until now, descendants have received a mandatory portion of three-quarters of the legal inheritance claim. With the revised inheritance law, the mandatory portion of descendants is reduced to half of the legal portion of the estate.

- Also, the parents have until now been deemed as heirs who are entitled by law to a portion of the inheritance, provided the testator has no children. With the new inheritance law, this mandatory portion no longer applies at all.

- And this is also true for certain requirements regarding the mandatory portion for the spouse in the case of divorce proceedings. However, the “estranged spouse” has to be excluded from the statutory order of succession in the will or inheritance contract.

How does the new inheritance law treat gifts?

The principle of the exemption of gifts currently applies: After an inheritance contract has been concluded, the parties are free to decide regarding their assets. In other words: Gifts made after the conclusion of an inheritance contract are generally allowed. These can only be contested if they are based on an obvious intention to harm.

Under the new legislation, the principle of a prohibition on gifts will now apply. This means that gifts (apart from occasional gifts) made after the conclusion of an inheritance contract can generally be contested, unless such gifts are expressly allowed under the inheritance contract.

Do I have to do anything for the new law to apply to my will?

If you have already drawn up a will, then the new mandatory portions apply automatically if you have not defined portions in your will but rather allocate the mandatory portion to an heir.

If you do not agree with the new mandatory portions, then you should draw up a new will: Either you assign clear portions without using the term “mandatory portion.” Or you stipulate that the old interpretation should still apply. If you mention only “mandatory portion” in your will, then the new mandatory portions shall apply.

It’s important to note that there is no transitional solution. If the testator passes before January 1, 2023, then the current inheritance law applies. If they pass on or after January 1, 2023, then the new inheritance law applies, regardless of the time when the will or inheritance contract was written.

How should my will be written in order to make sure it's legally valid and my wishes are implemented?

There are two legally valid types of will in Switzerland: the holographic will and the public will.

With the holographic will, you write it by hand, date it, and sign it. To avoid any misunderstandings, I would recommend getting a notary, lawyer, or legal expert to check your will. It may make sense to include with your will a medical certificate stating that you are of sound mind. This means your will cannot be declared invalid, for example if you develop dementia.

A public will is drawn up together with a notary – and signed by them as well as by two other witnesses. The witnesses mustn't be related; nor can they be beneficiaries of the will. A public will then needs to be deposited with the inheritance office or a notary.

Under what circumstances can a will be contested?

A will can be contested if it contains formal irregularities, e.g. the signature or date is missing, or the document wasn’t written by hand.

Also, if it can be proven that the deceased was not capable of disposing of their assets, if contents of the will are illegal or immoral – e.g. if an inheritance is offered on the condition that the heir first commits a violent act against someone – or if the power of disposal is exceeded, e.g. a breach of the provision on the mandatory portion.

What does an heir need to do in terms of tax returns?

You need to declare the inheritance in your tax return and submit a final tax return for the deceased.

Can I turn down an inheritance? In what cases does it make sense to do so?

An inheritance can be renounced within three months of the death. This makes sense if the estate is overindebted – in other words, if you inherit debts rather than assets. That's because unpaid loans, any installment agreements entered into, as well as mortgages, can also be inherited.

Two tips:

1. Do not take possession of any property or assets from the estate if you are unsure about whether to accept the inheritance. If you do so, you will no longer be able to turn down the inheritance. If you get involved in an inheritance before the estate has been divided, you will automatically have accepted the inheritance – even if you have not explicitly said so.

2. If the three-month period for renouncing the inheritance is insufficient, you should request an extension in good time.

I’m an only child. Who inherits if I turn down my parents' inheritance?

In Switzerland, your nearest statutory heirs will take your place if you renounce your inheritance. If all of the deceased's nearest statutory heirs turn down the estate, no other heirs can take their place. In this situation the inheritance is liquidated by the bankruptcy office, because it is presumed that the estate is overindebted.

As an heir, you should try to get a quick overview of the deceased's financial circumstances. Fact is, you will be liable for any debts with your personal assets.

What happens to furniture and other items that no-one wants?

If you accept the inheritance on your own or as part of a community of heirs, e.g. with your siblings, you can sell, give away, or dispose of the items no-one wants. If the estate is declared bankrupt, the bankruptcy office decides what happens to the deceased's possessions.

What happens to contracts after a relative dies?

Personal contracts such as an employment contract end at the time of death. Some – such as a rental agreement – come with special rights and can be canceled in the event of death: When a tenant dies, his or her heirs can terminate the agreement at the next statutory date of termination subject to the statutory notice period. All other contracts are passed on to the heirs.

What's the difference between a bequest and an inheritance?

The beneficiary of a bequest does not have the status of an heir: They do not belong to the community of heirs. This person's only claim against the heirs is to the payment/receipt of a bequest. In addition, the beneficiary of a bequest is not liable for inheritance debts.

Does grave maintenance also form part of the inheritance?

Funeral expenses are paid out of the estate. However, your legal obligations are fulfilled once the grave has been prepared for the first time. You are not required to take care of grave maintenance or pay the cost of grave maintenance on a long-term basis.

What do estate liabilities mean?

These are liabilities for which the heirs are responsible vis-à-vis the creditors of the estate. This could be the costs charged by the undertaker, but also unpaid invoices from a tradesperson – or other debts.

Funeral expenses must be paid by the deceased's closest relatives – even if they have turned down the inheritance.

Who has to pay a father or mother's funeral costs?

The survivors are required to pay for the funeral, as well as undertaker and burial costs, out of the estate.

If the value of the estate does not cover the funeral costs, only the direct heirs are liable: spouse, registered partner, children, and parents. These expenses must be paid by the deceased's closest relatives – even if they have turned down the inheritance.

Good to know: Some Swiss municipalities cover funeral expenses if there are insufficient funds in the estate. In this situation, the survivors must submit an application and cannot issue instructions to the undertaker themselves; otherwise they will be responsible for the cost.

If the person has died as a result of an accident, mandatory accident insurance (e.g. from Suva) will pay a portion of the funeral costs.

What types of funeral are permitted in Switzerland?

Cremation, burial, and tomb.