Have you spilled currant juice on a colleague's sofa? In most cases, liability insurance pays for the damage, but it helps to know what the term "present value" means before making any rash promises.

What's done is done. And in most cases, that's unpleasant enough. But then there's the issue of being responsible for property damage, which is why people are keen to allude to their liability insurance as a mean of paying for it. That sounds almost as good as a new sofa. Or a new camera. Or a new fitted carpet. But is this really the case?

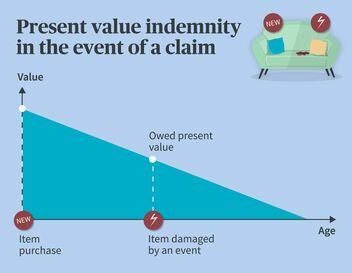

This masks a common misconception associated with insurance benefits: Confusing replacement value with present value. This is because present value is used for liability claims and not replacement value. This means an item's value based on its age, usage and wear and tear when the damage occurred. An item's normal lifespan is an important factor in this calculation. If this is 10 years, for example, and the item is already 11 years old, then the claim won't be met, as there is de facto no claim. However, if the item is new, present value equals replacement value. This approach is not an arbitrary one taken by insurance companies, but is consistent with applicable legal principles.

Present value: Replacement value of an item minus an amount for age, usage and wear and tear

You must know the new value of an object in order to calculate the present value. An amount known as depreciation, which is based on age, usage and wear and tear, is deducted from the new value. This difference is the present value. So the present value is the value of the insured object at the time of loss.

AXA and other insurance companies apply Swiss liability law (in German). This means that they cover the amount that the insured party is obliged to pay to the damaged party under statutory liability provisions. Providing a benefit means that someone's assets must have been affected. Above all however, the claim must be justified.

Even before present value is determined, another important insurance factor comes into play which is that liability insurance checks the damaged party's legal entitlement in the event of a claim. This can protect insured parties against expensive litigation because any legal challenges have to be defended by a lawyer.

Conversely, if you are the injured party and the party responsible for the damage refuses to pay for the damage they caused, then liability insurance will not step in to cover it. In cases such as these, legal protection insurance can help.

Back to present value: Low insurance benefits are of course disappointing when it specifically concerns older furnishings and technical equipment with rapid present value loss. Because even if you're sitting on a sofa that the law regards as worthless, it can still be quite comfortable. To settle the ideal claim, those causing the damage have no other choice here than to pay out of their own pocket.