Many dream of ending their employee job and becoming self-employed, but they fear uncertainty and financial bottlenecks. Don't worry: solid pension arrangements are also possible for the self-employed.

Congratulations! You've made the leap into self-employment and are starting your own business. You are full of enthusiasm and drive – at the same time, you have a lot of questions. Do you have enough start-up capital? Will my business idea work? And what if something happens to me?

In your situation, that is actually one of the most important questions. Because as a self-employed entrepreneur, you enjoy a great deal of freedom when it comes to pension provision. This also means that you bear a great deal of responsibility for yourself and your family. And for good reason, because employees and the self-employed do not have the same social protection. So don’t leave anything to chance when it comes to your pension provision.

Pillar 1 pension provision (Old-Age and Survivors’ Insurance, Disability Insurance, Loss of Earnings Compensation Scheme, Family Allowances) is mandatory for everyone, but you have to register yourself. To do so, contact the cantonal compensation office where your company is based.

Anything else is theoretically optional for you as a business owner, but there are definite recommendations. In terms of retirement provision and protection against long-term inability to work, Pillars 2 and/or 3 are imperative. In addition to the pension fund, daily sickness benefits insurance and accident insurance, although voluntary, are usually a matter of course in Switzerland. The financial risk is too great should you have an accident or not be able to work for a long period due to illness.

An overview and further information on insurance options can be found on our self-employment page. Use the Insurance Check to find out in just three minutes which types of insurance could make sense for your SME.

The Swiss pension system is based on three pillars: state, occupational and private pension provision. The system aims to ensure that people are financially secure in old age, if they become disabled or if someone they depend on dies.

The mandatory Pillar 1, also known as state pension, comprises old-age and survivors’ insurance (OASI), disability insurance (DI), and supplementary benefits (SI). It aims to secure livelihood.

Pillar 2 includes occupational benefits insurance (OPA) and accident insurance (AI). OPA is mandatory for employees with an annual salary of more than CHF 22,680 (as of 2025) and is the responsibility of the employer. Together with Pillar 1, it was originally intended to enable you to maintain your accustomed standard of living even after retirement. As this is no longer realistic in most cases these days, private pension provision has greatly increased in significance.

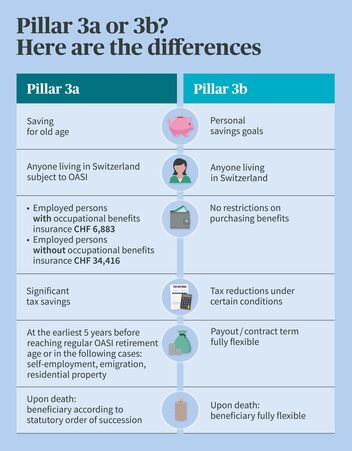

If you want to make private provision, you pay contributions into Pillar 3. This is a voluntary and flexible supplement to state pensions and occupational benefits insurance that can be used to plug pension gaps. It is paid out as a pension and/or in capital. There is a difference between tied (Pillar 3a) and flexible pension provision (Pillar 3b).

As a self-employed business owner, you are responsible for your retirement provision yourself. You should definitely join an OPA institution at your own instigation and/or make regular contributions into Pillar 3a or 3b, otherwise you risk facing a pension gap after retirement. AXA offers a range of occupational benefits solutions for companies as well as an attractive pension plan for private individuals .

Yes, in our view, this makes sense – unless they switch entirely to Pillars 3a/3b for their pension provision. Many owners of sole proprietorships, general or limited partnerships voluntarily join a pension foundation. Does your sector or industry association have its own pension fund perhaps? An alternative to this is always the OPA National Substitute Pension Plan Foundation. On behalf of the federal government, this foundation is the only occupational benefits institution in Switzerland to insure all interested employers and self-employed persons, but only with the mandatory minimum benefits.

There is a special case: anyone founding a joint stock company (AG) or a limited liability company (GmbH) is deemed to be an employee of their own company from an actuarial point of view. In this case, there is a duty of subordination and the pension fund assets must be transferred to the new pension fund. This also applies if there are no other employees besides you.

If anything happens to you, it can have far-reaching and long-term consequences, especially for you as a self-employed person. Not only for you, but also for your family and business partners. Depending on your life situation, occupational disability or term life insurance makes sense to protect those who are financially dependent on you.

You can reduce Pillar 2 pension provision. It is possible to insure only the minimum benefits or to pause payments. If business performance improves again, payments can be resumed.

Is your pension provision in tune with your needs, in respect of your professional life and retirement? Are you currently able to save for later? Consider the strengths and weaknesses of the different options and take your time to think about what makes sense in your situation. Joining a pension fund? Making regular payments into a Pillar 3a account? Or is loss of earnings your greatest risk? Discuss your personal goals with a pension advisor. If you haven't yet found the pension solution that suits you best, we're here to support you. Contact us.