Key points at a glance

- Payment security for your company: Credit insurance offers you financial security for the case that your customers fail to pay their invoices.

- Protect your liquidity: Thanks to this insurance, your company does not need to worry about any liquidity bottlenecks due to unpaid customer invoices.

- Prevention included: And AXA is here to help you with ongoing credit monitoring of your customers, allowing you to avoid payment defaults before they occur.

Purchase advice: 058 215 25 25

Who needs AXA's trade credit insurance?

Buy now, pay later: Buying on open terms is common. Many companies supplying goods or providing services in Switzerland pay in advance for their customers and therefore take on a major risk. However, if material and staff costs have already been incurred, but payment has not been received, this can quickly impact the financial existence of companies, especially smaller ones. Trade credit insurance is a simple and effective way of safeguarding the solvability of a company.

Legal situation

From a legal perspective, a payment term is a voluntary arrangement granted by the supplier to its customers. In the market however, granting (long) payment terms can often be the decisive advantage over rivals when it comes to winning a new order. This is because the principle of goods or services against payment in cash applies, which is why the seller has very few legal options if the payment is late or if it is not made at all. Of course, tools such as structuring the purchase contract, reminders and debt enforcement are helpful to avoid outstanding debts, but they cannot provide absolute security. You will only have this if you transfer the risk of financial losses from your business to an insurance policy.

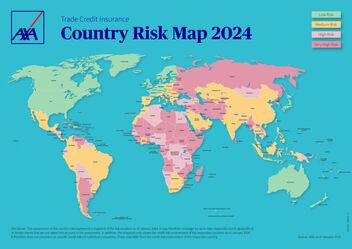

Country Risk Map

Internationally active companies are typically exposed to the risk of payment default. The country risk map of AXA credit insurance provides a comprehensive overview of worldwide country risks. The main objective is to assess the payment default risk of companies in a particular country. These classifications are tailored to offer guidance for your international business activities.

Support and frequently asked questions

Why considering trade credit insurance?

With trade credit insurance, you insure worldwide losses you suffer as a result of non-payment and insolvency of all your B2B business customers. Trade credit insurance is often a good idea to gain a competitive advantage. For example, if you offer your business partners more attractive purchasing conditions than your competitors and would like to guarantee your liquidity at the same time . Or if your business depends financially on a small number of customers and late payment could endanger your cash flow. Trade credit insurance is suitable for businesses that have an annual turnover of at least CHF 2 million and is mainly aimed at corporate customers.

I trust my long-term business partners - why do I need insurance?

Even long-term business relationships are not immune from bad debts. Deteriorating solvency often creeps in gradually with long-term business partners. Because of the good relationship, late payments are accepted, until it's too late. Making an objective assessment is that much harder as a result and that much more important, as this assessment is made by a neutral party.

What does credit insurance cost?

The level of premium is based on individual factors of your business model, such as turnover volume, business activity, outstanding balances or prior losses and is calculated as a percentage your turnover.