Save on health insurance premiums: 10 tips for you

Healthcare costs continue to rise in Switzerland, driving up health insurance premiums and impacting many households. But how can you save on health insurance premiums?

There are many ways to save, such as choosing the right insurance plans, using subsidized premium reductions or regularly switching health insurers. In this blog, we show you tips and tricks on how to make the best use of your savings potential and save on health insurance.

Tip 1: Select the right insurance model

In addition to the standard model with a free choice of doctor, the Swiss healthcare system offers other basic insurance models. Here are three of the most common:

- General practitioner model: Your general practitioner’s practice is your first point of contact.

- HMO model: Your first contact is via a selected doctor’s practice within the doctor’s network or a group practice.

- Telmed model: Your first point of contact is a telemedical advice center.

And there are also some models with other points of contact you can use to save money on health insurance, such as app-based offers. By choosing the right model, you can make significant savings on your health insurance premiums.

Please note: Make sure in advance that the model you want actually meets your needs. Where is your first point of contact? Do you have a free choice of doctors or does the treatment take place at an HMO practice? Is the model available in your region? Does your general practitioner belong to the insurer’s network of doctors? Find out more about the models and the Swiss healthcare system in our health insurance guide.

Tip 2: Select the right excess

The choice of excess (or “franchise”) has a direct impact on your health insurance premium. A higher excess means lower premiums, but you pay a greater proportion of your healthcare costs yourself. The opposite is true for a lower excess.

If you are healthy, rarely go to a doctor, and have financial reserves, the highest excess (usually CHF 2,500) is advisable. Otherwise, it makes more sense to stick with the lowest option (CHF 300). The intermediate levels are usually not worthwhile.

Tip 3: Make use of family discounts

Some health insurers offer a family discount under certain conditions. For example, if you insure two children with them. Check with your provider to see if you can save on health insurance premiums this way.

Tip 4: Compare premiums for different age groups

If your health insurer doesn’t offer a family discount, it’s worth using other savings options and comparing premiums from other insurers based on age. If you enroll your children in a healthcare plan with cheaper premiums, you could save hundreds of francs on health insurance.

Use our neutral health insurance comparison to find the right basic insurance for you in just a few clicks.

Tip 5: Pay your premium semi-annually or annually

If you are financially able to do so, you can save on health insurance premiums by paying them semi-annually or annually instead of monthly. Some insurance companies reward this with a discount of up to 2 percent.

Did you know?

The average monthly premium for basic insurance in 2024 was CHF 378.70.

Tip 6: Apply for a premium subsidy

Another way to save is to use premium subsidies to reduce health insurance costs. In Switzerland, almost 30 percent of those insured – especially children, young adults, and the elderly – are eligible.

It’s up to the canton to decide who benefits from a reduction in health insurance premiums. Each canton is responsible for determining who is entitled to a premium reduction, the amount of the reduction and how the procedure works in the premium region of that canton. Some cantons pay a premium subsidy automatically, while others require an application. This is why before you apply for a premium reduction, you should check to see whether you meet the requirements and contact your municipal office if you’re not sure.

Tip 7: Check your health cover for double accident coverage

If you are an employee who works at least eight hours per week, you are automatically insured against accidents under the AIA (in German). Accident coverage is therefore not necessary under your basic insurance. By excluding this, you can save up to 10 percent on your health insurance premiums.

Private accident insurance makes sense to supplement the benefits provided by compulsory AIA accident insurance. Private insurance offers more comprehensive benefits than accident insurance from the health insurer and does not require an additional excess or deductible.

You should notify your health insurer if you no longer have accident insurance through your employer. Under the Federal Health Insurance Act, accident insurance can be added to your basic health insurance – but this will increase your premiums.

Tip 8: Split your basic and supplementary insurance

The easiest and quickest way to save on health insurance is to split basic and supplementary insurance – this means that you do not take both of these out with the same provider. This way, you can find the best offers that are right for you and benefit from low premiums.

Note: Unlike with basic insurance, the insurer is under no obligation to accept you for private supplementary insurance. Your application may therefore be rejected based on your state of health. For this reason, never terminate an existing supplementary insurance policy until the new insurer has confirmed acceptance in writing.

Basic health insurance is required by law and covers the basic treatment necessary if you become ill. Supplemental coverage is voluntary and pays for benefits not covered under basic health insurance, such as alternative healing therapies, dental care and health spa stays.

Tip 9: Check that your basic insurance matches your situation in life

Under certain circumstances, such as during military service, it is possible to suspend health insurance or reclaim the contributions paid towards it. Check with your health insurance fund, especially as regards application deadlines.

Tip 10: Switch your health insurer regularly

Probably the most valuable tip for saving on health insurance premiums is to compare the different health insurers each year. This is because the benefits under basic insurance are defined by law and are the same for all providers. By contrast, the premiums can vary considerably from one health insurer to another.

The deadline for canceling mandatory basic health insurance is November 30. If this date falls on a weekend or a public holiday, then the deadline is the last business day in November.

Use our neutral and independent health insurance comparison to see at a glance what the premiums are for the various insurers.

How much money can l save by switching health insurers?

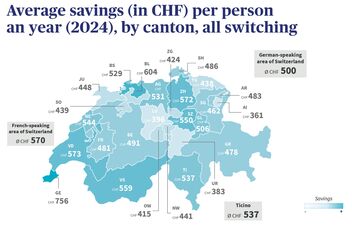

Depending on the household and policy, you can save several hundred francs a year on health insurance premiums by systematically switching. In 2025, AXA customers reduced their basic insurance premiums by a total of 25 million francs by taking out cheaper basic insurance. So it’s worth comparing premiums regularly and identifying the health insurer with the best rate. Another thing to note is the differences in savings by canton:

In 2026, you could save a lot on basic health insurance. Although premiums are set to go up by some 4%, if you carefully compare insurers and switch, you could save 11% on average – and the savings may even be over 20% for young adults. Depending on whether you’re looking to switch health insurers or models, adjust your deductible or take advantage of cheaper options in your premium region, you could save several hundred or even thousand francs. It’s often worth switching even without choosing a higher deductible.