Compulsory portion of heirs: what applies in Switzerland

In the complex world of inheritance law in Switzerland, the compulsory portion ensures that the next of kin don’t end up empty-handed. Spouses and descendants are entitled to inherit a minimum share of the estate. How is the right to the compulsory portion governed by law?

When a person dies, they become a testator. Their assets and debts (both referred to as the estate) are transferred to the legal heirs on the date of their death. However, if the deceased person has left behind a written will or an inheritance contract, the desired distribution of the estate may differ from the legal order of succession.

What is the compulsory portion?

Every testator can dispose of his or her own estate and determine who should receive what portion. However, this is subject to legal limits. For example, a deceased person can determine only a specified available part of his or her estate (Art. 471 SCC, in German). This is referred to as the free quota. You can find out more about succession and inheritance quotas in the article “Inheritance in Switzerland: inheritance law, succession and useful information”.

This means that, depending on how closely related heirs are to the deceased, they have a legal entitlement to a specified portion of the estate, known as the compulsory portion.

Who is entitled to a compulsory portion?

Only the spouse, registered partner and descendants of the deceased are legally entitled to a compulsory portion.

The life partner, parents or siblings have no legal entitlement to a compulsory portion, as this was abolished with the revision of inheritance law in January 2023. You can find out more about the changes in inheritance law in the article “Heirs in Switzerland: inheritance law, succession and useful information”.

How much is the compulsory portion?

The estate of a deceased person is generally distributed in accordance with the statutory provisions. For example, a woman with two children receives 50 percent of the estate, after the death of her husband, while the two children share the remaining 50 percent as a legal share of the inheritance.

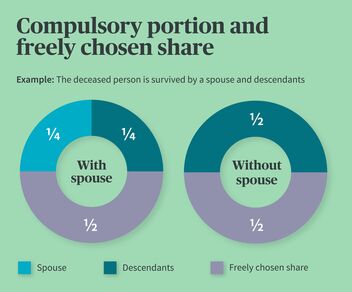

The amount of the compulsory portion is defined by law and depends on the structure of heirs. The compulsory portion of the surviving spouse and surviving descendants amounts to 50 percent respectively of the statutory portion of the inheritance described above.

- If the deceased has descendants, the estate is divided between the spouse and the children. In the example mentioned, the wife and the descendants each receive 50 percent of the estate by law. However, if a will or inheritance contract stipulates that all heirs receive only the compulsory portion, the entitlement is reduced by 50 percent each. This means that the wife and descendants receive only 25 percent of the estate (50 percent compulsory portion of 50 percent statutory portion of the inheritance). In this example, the husband is free to dispose of the remaining 50% of the estate.

- If beneficiaries predecease (die before) the testator, their share is divided among their descendants. If, in the example mentioned, one of the two children dies before the testator, his or her share of the inheritance is passed on to the testator’s descendants and thus to the testator’s grandchildren.

- If the deceased person does not leave a surviving spouse, all descendants together are legally entitled to 50 percent of the total estate. The testator can freely dispose of the remaining 50 percent and transfer it to a close relative or a foundation, for example.

Can the compulsory portions be adjusted?

Would you like to reduce the inheritance entitlement of your eligible heirs or disinherit heirs entirely? In Switzerland, this can be regulated in certain cases by means of a testamentary disposition (will) or an inheritance contract.

Will and compulsory portion

With a last will and testament, you can express your wishes without the consent of the heirs. However, an adjustment to the compulsory portions is only possible in exceptional cases.

In Switzerland, disinheritance is only permitted in the following cases:

- The heir has committed a serious crime against the testator or a person close to the testator

- Serious neglect of family responsibilities

However, if there are only personal conflicts or differences of opinion between the testator and the heir, disinheritance is not possible in Switzerland.

The specific reason for the disinheritance must be stated in the will for the disinheritance to be valid. If the disinherited person considers the reason for the disinheritance to be inadmissible, they can contest the disinheritance. If the statutory compulsory portions were violated in the will, these can be challenged with an action for abatement (limitation period one year after the opening of the will).

Inheritance contract and compulsory portion

In an inheritance contract, a waiver of compulsory portions can be agreed, if, for example, the descendants surrender their inheritance in favor of the surviving parent. This ensures, for example, that this parent can continue to live in their own property without the inheritance having to be paid out to their descendants. This way, you can avoid selling your home prematurely. For an inheritance contract to be valid, all parties involved must consent. The contract must also be notarized.

Request for compulsory portion during lifetime

The heirs are not entitled to their compulsory portion prior to the death of the testator. However, with an inheritance advance, part of the inheritance can be withdrawn early. However, this is only possible with the consent of the testator. You can find out what to consider in our article on the subject of inheritance advance.

Our tip: plan your estate in good time

In order to take charge of the distribution of your inheritance yourself, you should plan your estate in good time and draw up a valid will. You can also conclude an inheritance contract to avoid family disputes between the heirs. In this document, all parties involved agree on a distribution of the estate determined by the testator. In most cases, the spouse is the beneficiary.

In the case of an inheritance, you should also check whether the assets are needed directly or can be invested with a higher return.