Pension fund conversion rate: key points

Being the decision-maker for a company’s employees is a big responsibility, not least when it comes to occupational benefits. Regardless of whether you are starting up a company or switching pension funds, your choice of OPA solution has major repercussions for your employees’ retirement savings. The conversion rate plays a key role here – it determines how much employees will be able to save for their retirement.

What is a pension fund's conversion rate?

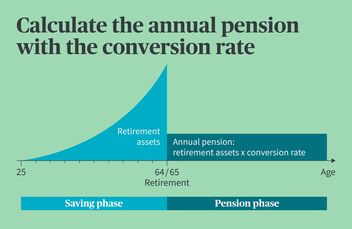

The conversion rate is a fixed percentage used to calculate the level of annual pension based on the amount of retirement assets saved.

The simple formula is retirement assets x conversion rate = annual pension

How is a pension fund's conversion rate calculated?

The conversion rates are determined by the federal government (mandatory benefits) and occupational benefits institutions (voluntary benefits), but these figures are not simply plucked out of the air. The following factors determine the conversion rates:

General life expectancy is a factor

In the first instance, general life expectancy must be mentioned. This is self-evident because the older the retirees become, the longer they will draw their guaranteed retirement pension.

Did you know?

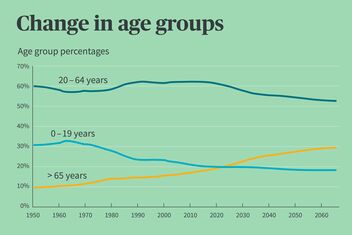

In 1948, the life expectancy of a 65-year old man was just 12 years, and that of a 65-year old woman a little more than 13 years. Today, the life expectancy is 22.7 years for women and 19.8 years for men. According to the Swiss Federal Statistical Office, the life expectancy of 65-year old women will rise to almost 27 years by 2060 compared to 27 years for 65-year old men.

Technical interest rate: earnings expectations affect the conversion rate

The technical interest rate is also a factor. This reflects what investment income can still be achieved on the insured's retirement assets during the pension period (i.e. on the portion of retirement assets that have not yet been paid out in the form of pensions). The technical interest rate is therefore influenced by the pension fund's expectations for long-term returns on low-risk investments.

Co-insured entitlements: the overall benefits package affects the conversion rate

When a retiree dies, benefits continue to be paid out under certain circumstances. For example, a surviving spouse or life partner may be entitled to a pension (e.g. 60 percent of the retirement pension). The conversion rate also has to factor in these benefits.

Trends & challenges for pension funds

One of the greatest challenges for Swiss pension funds is how to set sustainably fundable conversion rates. Due to demographic changes – which reflect the fact that the baby boomer generation is retiring and drawing benefits – the redistribution from workers to retirees is placing a growing strain on the occupational benefits system due to incorrectly calculated conversion rates. This must be offset, as this type of shift conflicts with the fully funded principle of occupational benefits which states that every generation is only paid as much in pensions as can be funded by the accumulated savings.

Variations in the conversion rate

But the conversion rate is not just a conversion rate. Depending on the circumstances, it varies based on whether the retirement assets are credited to the mandatory or voluntary portion.

The mandatory portion in occupational benefits

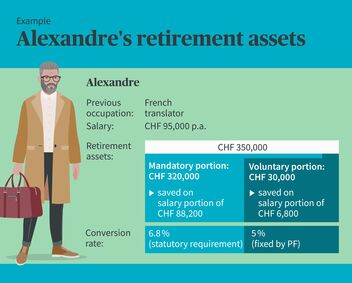

The conversion rate for the mandatory portion, notably pension fund contributions on an annual salary of up to CHF 90,720, is determined by the federal government. It is defined in the Occupational Benefits Insurance Act (OPA) and currently stands at 6.8 percent. As it is not legally permissible to apply a lower conversion rate, this is also referred to as the minimum conversion rate. Using the current minimum conversion rate, retirement savings of CHF 10,000 would therefore generate a pension of CHF 6,800 p.a.

The voluntary portion in Pillar 2

Pension institutions are not bound by a specific conversion rate for the voluntary portion of retirement assets (i.e. specifically the portion of pension fund contributions on the part of your salary that exceeds CHF 90,720). This means that the board of trustees is free to set that rate itself. Let's take a look at an example with Alexandre for a fictitious pension fund solution:

However, it's not always that simple, as there are also other options on the market.

Split vs. comprehensive conversion rate

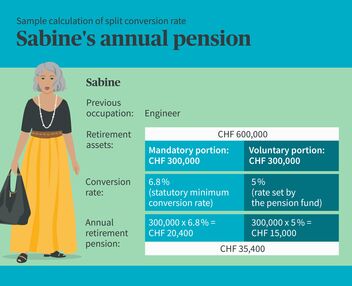

Many pension funds only recognize one conversion rate and apply this to the entire retirement assets. This is known as a comprehensive conversion rate. However, if a different conversion rate is applied to the mandatory and voluntary portions of retirement assets, this is known as a split conversion rate.

Split conversion rate

If a split conversion rate is applied, the mandatory and voluntary portions are regarded separately and converted at the intended conversion rate .

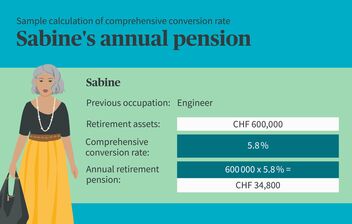

Comprehensive conversion rate

With a comprehensive conversion rate, a single conversion rate is applied both to mandatory and voluntary benefits.

A comprehensive conversion rate below the minimum conversion rate (6.8 percent) is only possible if the statutory minimum pension is always maintained for every insured. This is based on the mandatory portion to which the minimum conversion rate is applied. In Sabine's case, this means: 6.8 percent of 300,000 = CHF 20,400. As her retirement pension amounts to CHF 34,800 in total when the comprehensive conversion rate is applied, this statutory requirement is met and the pension fund may pay the retirement pension calculated with the comprehensive conversion rate. Should the comprehensively calculated retirement pension be lower than CHF 20,400, the pension fund would have to increase the retirement pension to this amount. A pension fund also has to carry out the same control calculation (shadow accounting) if it applies a split conversion rate, but a conversion rate below the minimum conversion rate is used in the mandatory portion.

Does the amount of the conversion rate: Affect the retirement savings of future generations?

Yes. A higher conversion rate also has an impact on the pensions of future pension recipients, i.e. today’s young people – and a negative one at that.

If the conversion rate is too high, retirees won’t be able to rely on these pensions as their sole source of retirement funding. This means that the money that would otherwise go to insureds who are still working today must be used to fund current pensions instead. If retirement savings earn an attractive rate of interest throughout the employee’s working life, then their pension will still be larger, even if the conversion rate is somewhat lower.

Summary: what should you bear in mind when it comes to pension fund conversion rates?

What should company decision-makers consider when fulfilling their responsibility of finding the right OPA solution for their employees? The key to choosing a pension fund is to take full account of its long-term financial and structural performance and risk profile (e.g. through relevant figures) and at the same time also take a closer look at pension fund conversion rate models.

The following applies to the conversion rate in particular:

- the higher the conversion rate, the higher the retirement pension in relation to the saved retirement assets.

- To maximize the reduction in shift between the generations, the conversion rate should be sustainably fundable by the pension fund, i.e. realistically calculated.

- Depending on how retirement assets are divided into mandatory and voluntary benefits, a split rather than a comprehensive conversion rate may be more advantageous.

- Apart from the conversion rate, the interest on the amount of the future pension is also important: If the retirement savings earn attractive interest over the course of an employee's working life, then this together with compound interest can increase their retirement pension.