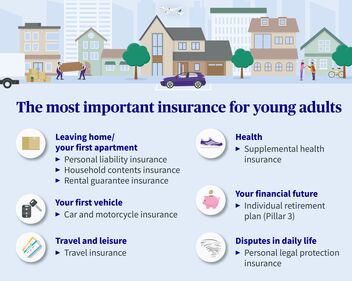

Moving into your first apartment, the first time you cruise around in your own car, or your first major trip: Becoming an adult is an exciting time with many memorable moments. And with the right insurance coverage behind you, the adventure can begin.

We help you find your way through the insurance jungle: What insurance do you need, and what is nice to have?

Get off to a carefree start in life – with AXA as a strong partner by your side.

myAXA client portal: Manage documents, upload invoices, or change your personal data – whenever and wherever you want. Say goodbye to paperwork!

We are Switzerland's number one insurer: We provide excellent services, personal advice, and individual insurance protection.

Offers for young people: 15% Safe Driver Bonus, 3 months’ premiums for free when you take out personal liability and/or household contents insurance and 2 months’ premiums for free when you purchase travel insurance.

Concerts, soccer games or festivals: We cover the cost of your ticket if you can’t attend the event. This offer is valid for anyone under 30 who is not yet insured with AXA.

In Switzerland, there are various types of insurance that are mandatory. For example:

In Switzerland, children under the age of 18 are co-insured under their parents’ health insurance. After that, they can be covered by their parents’ insurance until the age of 25 provided they are completing a vocational training/education program or a comparable activity. This also applies to children who take a break between two training/education programs or complete an education/training program abroad.

If the child is still in the program or comparable activity after the age of 25, then they can stay co-insured under their parent’s insurance if they don’t have their own health insurance. However, in this case, the parents have to pay a higher contribution.

Good to know: While all basic insurance policies in Switzerland have the same benefits, their premiums differ. That’s why it’s worthwhile to make a neutral comparison of health insurers. Thanks to our health insurance fund switching service, you can also choose your new basic insurance quickly and easily.

AXA’s supplementary insurance modules: In the outpatient segment, the supplementary insurance contributes to the costs of glasses and contact lenses, gym memberships, and complementary medicine. With inpatient hospital benefits, you can choose between general, semi-private, and private coverage. We offer you additional protection for your teeth, for when you are traveling, or in the case of hospital stays, disability, or death.

It is important to note that the exact rules may vary depending on the health insurance and your individual situation. If you have any questions on your individual insurance situation, we’ll be happy to help: Request a consultation now!

For household insurance (household contents plus personal liability), the principal generally applies that all persons recorded in the policy who live in the same household are insured. And this is true regardless of their age. However, a separate insurance policy can be created for adult children if the parents request it. In this case, they can benefit from a youth discount up to the age of 25. We would be happy to answer any questions you have on our offers: Request a consultation now!

Every roommate in a shared apartment can theoretically take out an individually policy for their possessions (household contents insurance). However, it is less expensive if all roommates of the shared apartment have a joint policy – multi-person insurance.

The disadvantage of this type of insurance is that, as a rule, all persons are required to live in the same household and are listed by name. In most shared apartments, there is often frequent change in roommates, which can lead to a lot of time and effort to delete names and add new ones.

The rental guarantee that is most accepted in Switzerland is rental guarantee insurance. This guarantees the same security as a custody account at a bank and has the advantage that it is faster and more straightforward. For an annual fee, landlords can receive the guarantee and your money stays available.

Here’s what you get with rental guarantee insurance from AXA:

In order for AXA to stand surety for you, you must have personal liability insurance.This insurance already covers many types of damage that can occur in a rented apartment and is thus generally very useful for tenants.