Legal forms: The right choice when starting your own company

Choosing the right legal form is an important step in founding a company. It is a strategic decision with long-term consequences for the entire organization. The legal form affects various legal, financial, and operational aspects.

It determines how the company is recognized before the law and which legal obligations this leads to. In Switzerland, you have various legal forms to choose from, including the sole proprietorship, the limited liability company (GmbH), or the joint stock company (AG). Each of these forms has its own features, advantages, and disadvantages. But what should you generally bear in mind when choosing a company form?

And which legal form is the right one for your company?

- Liability: Personal liability is a factor you should keep in mind when founding a company. To protect your personal assets against business debts, you should found a corporation like a GmbH.

- Capital requirements: The starting capital at your disposal plays an important role. A sole proprietorship, for example, requires less capital than a GmbH or AG.

- Taxes: Tax and accounting obligations vary according to the legal form chosen. Corporations such as GmbHs and AGs often have more complex accounting obligations. And you would then also have to keep personal and company taxes separate, as they are each separate tax subjects.

- Flexibility: Consider how much control and flexibility you want to have for your company. Sole proprietors have full control, while owners and partners of other company forms have to make decisions jointly.

- Credibility: In some sectors, the choice of a legal form can impact your credibility among clients and business partners. Corporations are often considered to be more stable and reputable.

- Financing: If your goal is to obtain external investments, corporations are generally more attractive, as you can issue shares. Sole proprietors, on the other hand, have more limited options for external financing.

- Administrative effort: Take account of the administrative work required. Corporations have more complex requirements, while sole proprietorships and ordinary partnerships are easier to manage.

The various legal forms in Switzerland

Ordinary partnership

The ordinary partnership does not require an actually founding and has no minimum capital requirements. Often, it serves more as an initial step toward taking other legal forms. If two friends work together on a project with a joint goal, this can represent an ordinary partnership – even without an active act of founding. This applies even if the friends would not label it as such. If the project turns into a larger enterprise with actual investments and risks, then the ordinary partnership is usually replaced by a more complex legal form.

Sole proprietorship

- Definition and features

A sole proprietor is a natural person who operates a company alone, without a partner or co-owner. This means that they make all the decisions and have full control over the company. In Switzerland, the legal form of sole proprietorship is widespread, especially among microenterprises and freelancers. Sole proprietorships can also be converted at a later time, into a GmbH or AG, for example.

- Capital requirements

The capital requirements for founding a sole proprietorship in Switzerland are comparatively low. There is no minimum capital required and the founding costs are rather low at approximately CHF 500. Sole proprietorships can start with their own capital or take out loans to finance the company. - Sole proprietorship: Advantages and disadvantages

Advantages:

- Easy founding: If you want to start your own company, then founding and registering a sole proprietorship in Switzerland is comparatively straightforward and inexpensive. There are no costly contracts or formalities required.

- Full control: You keep full control of your company and can make decisions quickly, without having to account for partners or other co-owners.

Disadvantages:

- Personal liability: One significant disadvantage is that you can be held liable with your personal assets for the debts of the company.

- Limited resources: Sole proprietorships often have limited financial and staff resources.

Limited liability company (GmbH)

- Definition and features

A limited liability company is one of the most popular legal forms in Switzerland. It is a legal entity founded by at least one natural person or legal entity. The GmbH has its own legal personality. For this reason, it is legally independent of the founders. This allows the GmbH to conclude contracts, own assets, and take legal action or be sued in court. - Capital requirements

The capital requirements for founding a GmbH in Switzerland are higher than other legal forms. The minimum investment is normally CHF 20,000. This amount must be paid in cash or tangible assets. The capital paid in serves to protect the interests of creditors. At the same time, it increases the credibility and creditworthiness of the company. - GmbH: Advantages and disadvantages

Advantages:

- Limitation of liability: One significant advantage of a GmbH is the limited liability of the company partners. As a rule, their personal assets are protected against the debts and liabilities of the GmbH.

- Capital raising: GmbHs can raise capital from numerous partners which makes it easier to access financial resources. This in turn enables the company to finance bigger projects and grow faster.

- Legal independence: As a legal entity, the GmbH can conclude contracts in its own name, purchase real estate, and enter into long-term business relationships.

Disadvantages:

- More complex founding: The founding formalities for a GmbH are complex and cost-intensive. A company contract, notarization, and entry in the commercial registry are required.

- Administrative effort: A GmbH requires a certain amount of administration, including the convening of partners’ meetings and bookkeeping.

Joint stock company (AG)

- Definition and features

A joint stock company (AG) is one of the most common legal forms for a company in Switzerland. It is a legal entity that has capital divided into shares which are held by shareholders. The shareholders are owners of the AG and have the right to participate in general meetings and vote on company matters. An AG has its own legal personality, which means that it exists in a legal sense, independently of its shareholders. As a legal entity, the AG has the same rights and obligations as a natural person (except, of course, for the rights and obligations that only can be fulfilled by the natural characteristics of a person). - Capital requirements

The capital requirements for founding a joint stock company (AG) in Switzerland are comparatively high. A minimum of CHF 100,000 in capital is usually required, although at least half of the nominal value of the shares must be paid in when the company is founded. This capital serves to protect the interests of creditors and ensure the credibility of the company. However, shareholders can pay in more than the minimum amount. - AG: Advantages and disadvantages

Advantages:

- Limited liability: As a rule, the shareholders are held liable only up to the amount of their invested capital, which protects their personal assets against the company's debt.

- Raising capital: With an AG, it is easier to raise capital because shares can be issued and external investors brought in. This makes it easier to grow and expand.

- Reputation and credibility: AGs often enjoy greater creditworthiness and are popular among investors, clients, and business partners.

Disadvantages:

- Higher founding costs: The founding process for an AG entails higher founding costs compared with other legal forms.

- More complex administration: AGs have more complex administrative requirements, including compliance with accounting and reporting obligations.

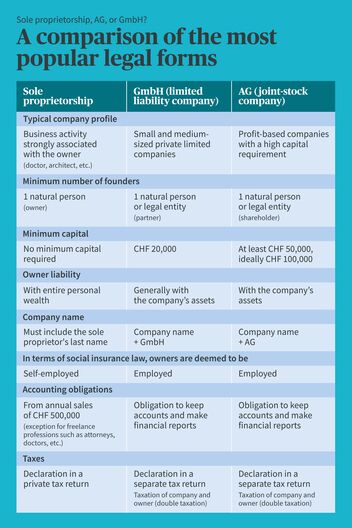

Comparison of the different legal forms at a glance