Realize your dream of having your own company – it’s really not that complicated to do. What do you need to bear in mind if you want to become self-employed? We’ve compiled the most important tips for starting a company in Switzerland for you here.

From the business idea and selecting the right legal form, to insurance and pension solutions – we go through the most important steps in founding a company together with you. Let’s get started!

4. Determine your need for capital

5. Choose a suitable legal form

7. Consider the necessary social insurance

8. Determine your insurance needs

9. Take tax aspects into account

10. Don’t forget retirement provision

Everything starts with a good business idea. Nevertheless, if you want to found your own company, you don’t necessarily have to reinvent the wheel. You can buy an existing company, for example, or consider opening a franchise.

Or you can proceed with an existing business idea and improve on it. The majority of founders start with products and services that they are already familiar with. The big advantage here is that if you have worked successfully for many years in a certain field, then you know the central needs and problems of the market. Close contact with customers is a revealing source of information when it comes to improvements, product innovations, and gaps in the market. Industry insiders also have the right network and know potential customers and suppliers personally. Ideally, you also work in an ambitious team which supports you in growing your business.

If you want to launch something completely novel on the market, it is a unique opportunity, but also a major challenge. For this reason, new ideas always need to solve an existing problem and/or improve the status quo. This is the case if you are cheaper, more efficient, simpler, or more holistic than your competitors .

No matter which business idea you go for: A market analysis is a good first step to estimate the potential of your idea. A business model canvas can also help you to visualize your idea and determine any possible weak points.

You have settled on a business idea. Now you have to turn it into reality. A business plan is good way to do so.

From your company’s objective to competitors and pricing policy: With a business plan, you turn your idea into a fully fledged strategy. It serves as the guidelines for the development of your company and can be provided to financial institutions to raise capital, for example. That’s why it is important to update your business plan regularly. That way, you can ensure that you don’t lose sight of the goal you set when you became self-employed.

Does making a business plan sound like a lot of work? The Swiss SME portal provides founders with free templates and samples .

Do you already have some initial ideas for a company name? When choosing your company’s name, make sure you don’t infringe on any trademark rights. You should also check whether the corresponding domain is available for your website. Depending on the marketing concept, you should also see whether you can create social media profiles with the name and whether the name has already been taken by other users.

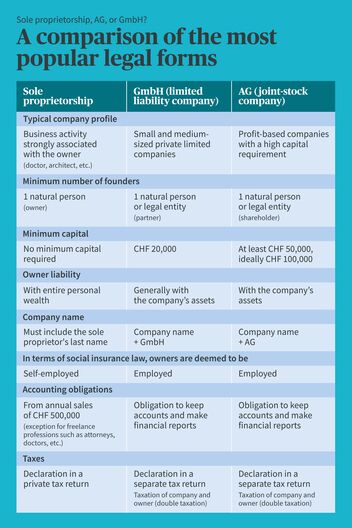

Good to know: Depending on the legal form you choose, you may have to include certain elements and observe certain requirements for the company name. For a sole proprietorship, your last name must be a part of the company name, for example. On the other hand, for a GmbH or AG, the legal form must be part of the name.

The following provisions set out the most important rules for creating a company name:

If your company name violates the rules on company founding, then it cannot be entered in the commercial register. If you want to check before founding the company whether the company name complies with the legal provisions, you can submit your proposal to the competent cantonal commercial registry office for advance review.

To the overview of all cantonal commercial registry offices

Start-up founders have lots of options when it comes to funding their business model. For example:

The amount of capital you need to found your company depends on various factors. For example, the required start-up capital varies greatly by legal form:

Other costs besides start-up capital are incurred when you start a company. In addition to one-time payments, there are also ongoing expenses, such as your own cost of living, the rent for your shop space, employee wages, procurement costs for equipment and inventory, and budgets for marketing measures.

Take the time to determine what your capital requirements are and obtain advice. Tight finances represent a significant risk: In the event of bankruptcy, sole proprietors can be held liable in a worst-case scenario with their personal wealth. That’s why we recommend planning for a bridging reserve covering at least six months. You can obtain professional advice on start-up platforms such as startups.ch, from business coaches, your bank, or in one of AXA’s liquidity planning workshops:

The federal government does not grant any direct financial support for the founding of new companies. Instead, it strives to create favorable conditions for founding new companies. The only exception is unemployment insurance: It provides support measures for unemployed persons who would like to start their own company. New start-ups can obtain additional support in the form of scholarships, subsidies, competition prizes, or research funds from universities, for example.

Sole proprietorship, partnership, or corporation – the choice is yours when you want to become self-employed. If an individual is managing a business in the commercial sense under his or her own name and on his or her own behalf, this constitutes a sole proprietorship. This legal form is popular and the gateway to self-employment for many start-ups.

A sole proprietorship consists of a sole business owner. To have a sole proprietorship, you must be recognized as self-employed by your compensation fund. Founders of this legal form remain natural persons.

If you’re a sole proprietor, you qualify as self-employed.

In the case of corporations, the focus is on the capital paid in. In Switzerland, the AG (Aktiengesellschaft – joint-stock company) and GmbH (Gesellschaft mit beschränkter Haftung – limited liability company) are very popular. As a legal entity , the corporation is given its legal capacity upon entry in the commercial register. For liabilities, the AG and GmbH are liable with the company’s assets.

Sole proprietorship, AG, or GmbH? A comparison of the most popular legal forms

Are you ready to become self-employed? Then it’s time for the actual company founding. The founding process varies depending on the type of legal form.

A sole proprietorship is created once a business activity begins – and not through an entry in the commercial register as with GmbHs or AGs. Only from a generated annual revenue of at least CHF 100,000 are you obligated as the owner of a sole proprietorship managed as a commercial enterprise to have your company entered in the commercial register.

It’s important to note that to qualify as self-employed in Switzerland, you have to have your self-employment reviewed and recognized by the responsible compensation office (AHV). Once you have started your business activity in self-employment, you have to register with the compensation office to do so. The compensation office of the canton where your company is domiciled is responsible.

To review your application, the compensation office needs proof of self-employment. That’s why registration is retroactive. Include documents with your application that prove you are self-employed. These may comprise, for example, offers and invoices, advertising materials, or a description of your activity. An entry in the commercial register is not enough for approval of self-employment.

A corporation such as a GmbH or AG is founded with an entry in the commercial register and the founders’ meeting of partners in the presence of a notary (public notarization).

Through the founding, your company obtains a legal capacity and is from that time considered to be a legal entity.

The commercial registry office of the canton where your company is domiciled is responsible for registration. You will find an overview of the required documents and data from your commercial registry office.

To register the company with the commercial registry office, information on the persons to be entered in the commercial register, the officially notarized signatures of the founders (GmbH) or the members of the board of directors (AG), as well as the notarized founding documents are required, for example. You can obtain help for preparing founding documents from attorneys, notaries, or fiduciaries.

During the registration process, GmbHs and AGs also have to provide information about their organization, such as the management regulations (GmbH) or regulations of the board of directors (AG). For this reason, you should clarify the following points before you submit your commercial register entry:

Once you have compiled all the founding documents, we recommend having the registration draft reviewed in advance by the commercial registry office. In addition, submit the documents that need to be notarized to your notary in good time and arrange an appointment for the notarization of the founders’ meeting.

If you have finished all preparations, submit your registration in person or by mail to the commercial registry office. After the review has been completed, the entry will be made in the cantonal commercial register within approximately seven days. The entry in the Swiss Federal Commercial Registry Office and publication in the Swiss Commercial Gazette SHAB is made after that.

Finished! Your corporation has been successfully founded. If you provide your bank with your extract from the commercial registry, you can then access your share capital and immediately have the complete power to act.

Social insurance serves as a social safety net for the Swiss population. It includes obligatory insurance that cover basic risks. It pays benefits in the form of pensions or contributes to covering costs in the event of an accident or illness. Social insurance includes, for example, old-age and survivors’ insurance (AHV), occupational benefits insurance (BVG), maternity insurance (MV), and accident insurance (UV).

Employees in Switzerland are automatically insured under AHV and have mandatory coverage against invalidity, death, and poverty in old age. On the other hand, self-employed persons are obligated to take care of their own insurance. The legal form of the company thus determines their position under social insurance law as the owner – and whether they have to register with AHV independently.

To the registration for AHV/IV/EO/ALV at easygov

We recommend calculating the costs for social insurance as normal expenses in your budget. Social insurance is obligatory or voluntary, depending on the legal form of your company:

Employing staff comes with certain obligations attached. In Switzerland, for example, the law requires that all employees be insured against disability, death, and poverty in old age. Employers must pay social insurance contributions. These include employer and employee contributions to AHV, IV, EO, and unemployment insurance, as well as employer contributions to family allowances.

These employee social insurance contributions are handled through your compensation office. All employees must also be insured against occupational accidents and disease.

An overview of the required registrations:

Supplementary to social insurance, so-called business insurance covers risks that could be dangerous to your company in the start-up phase.

Whether work-related absences, technical interruptions, or cyber attacks: Business insurance protects against incidents that can throw your dream of self-employment off course. For this reason, you should ask the following questions when choosing the right insurance: Which risks will my young company face? And which can I or do I want to bear on my own, and which do I want to pass on to my insurance?

The good news is that for start-ups and self-employed persons, most occupational benefit insurance policies can be freely chosen. You can find out more about what you should bear in mind on our pages “Insurance for the self-employed and & start-ups” and in our practical insurance check:

Another point you should consider when planning your budget: Taxes. Here, too, the legal form of your company plays an important role:

This overview from SECO shows which taxes are levied at a federal, cantonal, and municipal level depending on the legal form.

When it comes to value-added tax, the legal form of your company plays a subordinate role. The rule of thumb is that If you generate annual revenues with your company of at least CHF 100,000 for services rendered in Switzerland then you are subject to value-added tax. You then have to account for two things:

Many founders think of themselves last. However, you should certainly not forget your personal retirement provision. Here, too, your company’s legal form sets the framework conditions:

Congratulations! You’ve taken the bold leap into self-employment and started your own company!

The adventure of being an entrepreneur can begin: The first few months and years are decisive for establishing your young start-up. How will your company assert itself on the market? When will it notch up its first big success? Is the legal form you chose in the beginning still the right one? Is it time to switch to an AG or a GmbH?

The AXA team will be happy to provide impartial advice and valuable tips, even after you start your company. Contact us – we’ll get back to you shortly.