Liquidity planning: fundamental financial guidance every company can use

Liquidity planning is an essential part of financial management for companies. It is the foundation used to build a solid financial position and helps to ensure financial stability and growth.

Regardless of their size or sector, companies in Switzerland are faced with numerous financial challenges on a daily basis. From paying employees and suppliers to managing unexpected expenses, running a successful company requires careful financial planning. This is where liquidity planning plays a part in the business plan.

The liquidity plan – navigating your financial future

A liquidity plan, which is often called a cashflow forecast or liquidity outlook, is a strategic tool companies can use in their financial management. It is a structured forecast outlining how the liquidity in a company will evolve over time. The projection uses an estimate of revenue and expenditure to create a roadmap for the company to ensure it has sufficient financial resources at all times.

The role of liquidity planning in the financial management of a company

Liquidity planning is not merely a forecast; it also continually monitors the company’s current financial situation. Specifically, it performs the following tasks:

- Early warning system: A liquidity plan serves as an early warning system for financial challenges. It identifies shortages before they happen, enabling the company to be proactive and take the necessary steps.

- Financial management: By planning and managing income and expenses, companies can optimize their financial health. This makes it possible to use resources more efficiently and minimize the danger of liquidity problems.

- Investment decisions: When planning investments, it’s essential to have a liquidity plan. It helps you evaluate how much you have available to spend on new projects or expansions without putting your current commitments at risk.

Why liquidity planning is essential

- Guaranteeing solvency: Liquidity is the ability of a company to meet its current liabilities on time. Effective liquidity planning ensures that there are sufficient funds on hand at all times to pay invoices and meet financial obligations. This helps the company to avoid defaulting on payments and maintain the trust of its suppliers and business partners.

- Crisis management: Unexpected events, such as economic downturns or unforeseen expenses, can hit a company hard. A well-thought-out liquidity plan lets a company manage crises without endangering its long-term financial health. It creates a cushion that can prove life-saving during times of turbulence.

- Financing growth: Companies that want to grow need capital. Liquidity planning helps them figure out how much they need for future investments and expansion. It also indicates when and how much funding is required to take advantage of growth opportunities, whether through expansion, product development or entering a new market.

- Trust of investors and creditors: Both investors and creditors will take a close look at the financial health of a company. A sound liquidity plan shows them that the company has its finances under control and is in a position to pay back its investments and loans. This makes it easier to find funding and partners.

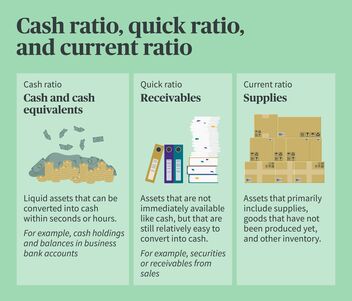

Cash ratio, quick ratio and current ratio

Liquidity is by no means uniform across the company. It can be divided up into different ratios which reflect the different aspects of the company’s financial stability. Although some of these liquid funds can be accessed more quickly than others, ultimately they are not intended to serve as a cushion for unforeseeable events. They are a fixed component of a well-thought-out liquidity plan.

- Cash ratio – cash and cash equivalents

The cash ratio is the highest level of financial liquidity. It includes cash and cash equivalents that can be converted into cash within seconds or hours, which simplifies short-term liquidity planning. This includes, for example, cash on hand and balances on commercial bank accounts. - Quick ratio – receivables

Quick ratios include assets that, unlike cash, are not immediately available, but that still can be converted into cash relatively easily, e.g. securities and accounts receivable. These can be added to the liquid assets in the cash ratio in order to see whether they will be able to cover current liabilities. - Current ratio – inventory

The current ratio refers to assets that primarily include supplies, unfinished goods and other inventory.

Finally, assets must always be proportionate to liabilities. Here, liabilities are roughly broken down into current and non-current liabilities.

- Current liabilities: This generally refers to liabilities that are expected to be settled within one year and also includes recurring liabilities such as wages and salaries, taxes, etc.

- Non-current liabilities: These include liabilities that are expected to be settled after one year or more. Mortgages are a classic example.

A calculation is used to determine what is known as the liquidity value. A value of 100 percent means that all liabilities can be met with the funds that are available.

Spreadsheet or software: What can a company use to make a liquidity plan?

Liquidity planning can be done using a spreadsheet or with the help of specialized software that simplifies and speeds up the process. Both methods have their pros and cons. Which one you choose often depends on your company’s individual needs and resources.

Spreadsheet: The tried and true method

Advantages:

- Widely used: Spreadsheets are widely used and well known. Most employees know how they work, which makes using them easier.

- Flexibility: Spreadsheets can be used to create tailored models and formulas that reflect the specific needs of the company.

- Cost: In many cases, a spreadsheet tool is the more affordable option because it is already available on most computers.

Disadvantages:

- Must be done by hand: Maintaining and updating spreadsheets often requires a lot of manual labor, which also involves a certain degree of mistakes and inefficiency.

Specialized software: The latest solution

Advantages:

- Automated: Specialized software automates many tasks and significantly reduces the workload involved.

- Collaboration: The software facilitates seamless cooperation and data sharing between the various departments and team members.

- Advanced functions: This software provides advanced functions for data analyses and forecasts.

Disadvantages:

- Cost: Specialized software is often more costly, in terms of both the licensing fees and the training needed.

- Orientation: Training and time may be needed to learn how to use the software.

- Dependency on providers: The company will be dependent on a software provider, which poses some risks in terms of maintenance and support.

Can you make a liquidity plan without knowing what your revenue for the next few months will be?

Creating a precise liquidity plan can be a challenge, especially if you don’t know what your revenue will be over the next few months. However, there are tried and trusted strategies and methods that help companies to prepare for unexpected events and shore up their financial stability.

- Use conservative estimates: In times of uncertainty, it’s advisable to use conservative estimates for your income and expenses. Make sure your income estimates are a little lower and your expense estimates a little higher in order to create a cushion for unexpected events.

- Run scenario analyses: Create several scenarios based on different revenue forecasts and external influences. This will enable you to be prepared for whatever happens.

- Cost controls: Carefully review your recurring expenses and identify the areas where you could save on costs. Lowering unnecessary costs helps free up liquidity.

- Build up liquidity reserves: It’s always a good idea to have on hand a certain amount of liquidity reserves that you can use to navigate unforeseen situations. These reserves can take the form of short-term investments or untapped credit lines.

- Strict receivables management Make sure to track your outstanding receivables and set short payment deadlines. This increases your liquidity and reduces the risk of delayed payments.

- Communication and planning: Open communication with relevant partners, such as suppliers and financial institutions, is vital. Plan ahead for how you will deal with any financial challenges that may arise.

What is included in a liquidity plan?

Incoming payments:

- Revenue: This is income from the sale of goods or services and normally accounts for the bulk of incoming payments.

- Income from interest: If the company earns income from interest on short-term investments or loans, it is included here.

- Dividend income: If the company receives income from dividends on investments in other companies, it is included in this category.

- Capital increases: If the company receives additional capital from investors or owners, these funds flow into liquidity as well.

Outgoing payments:

- Operating expenses: This includes salaries, rent, employee benefits, cost of raw materials, marketing and distribution costs as well as other regular business expenses.

- Taxes: This includes estimated tax payments, including income tax, VAT and other taxes.

- Social insurance contributions: The contributions to social insurance are listed here.

- Loan repayments: If the company has taken out a loan, the payments are listed here.

- Investment expenses: The costs for new systems, equipment or projects that are not used for day-to-day operations are recorded here.

- Dividend payments: If the company pays dividends to its owners or shareholders, these payments are also taken into account.

What happens if a company has no financial or liquidity plans?

Capital requirements, private investments, borrowed capital, accounting rules and payment streams all make it that much more important to have an overview of your liquidity at all times. Without a solid financial and liquidity plan, a company is setting itself up for problems when it comes to paying wages, supplier invoices and loan obligations. What’s more, if a company fails to settle its bills, its suppliers, customers and investors will lose trust in it, putting its long-term relationships at risk.

In the worst case, these payment difficulties and loss of trust could lead to bankruptcy, which, in turn, could trigger a whole slew of consequences.

- Assets held in custody (share capital or shares) are included in the bankruptcy assets and will therefore be lost. If you are a sole proprietorship, your personal assets are also at risk.

- Creditors – i.e. other companies, suppliers, etc. – will be affected by your bankruptcy if you can no longer pay your bills, which may cause them to suffer financial difficulties themselves.

- Your personal reputation suffers. As the owner of a GmbH or a sole proprietorship, you are the public face of the company. If at some later point in time you decide to start another company, you may run into difficulty trying to raise the money you need because your credit rating has taken a hit.

AXA can help you shore up your financial stability and minimize the risk of bankruptcy. You can go to liquidity workshops, become part of a start-up network or take out insurance that prevents you from having to pay unexpected claims for damages.