Semi-autonomous pension fund or full-value insurance?

Having to make a choice can be difficult – the managing directors and HR managers of SMEs in particular know this to be true. They make key decisions everyday for their companies: from recruiting, to delegating responsibilities, to choosing a pension fund for their employees.

This last decision requires thorough consideration because it affects the financial future of the company’s most important resource – its employees. If companies (SMEs in particular) are unable or unwilling to create their own pension fund, they can join a collective foundation. The trend in company retirement plans is moving away from full-value insurance toward semi-autonomous pension funds.

Which solution is best suited to your company?

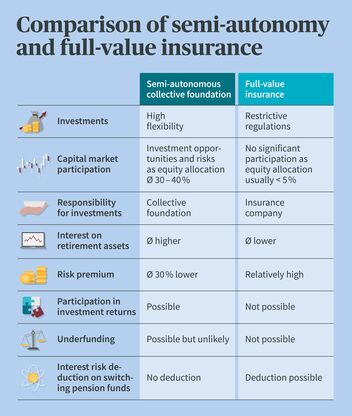

This is not a simple question to answer. Depending on whether your company is looking for maximum security or a higher interest rate on retirement savings, this will determine whether full-value insurance or a semi-autonomous pension fund is the right solution for you. We have drawn up a comparison of both semi-autonomous pension solutions and full-value insurance solutions. Our conclusion: In the current environment, insureds have considerably better long-term prospects for a larger retirement pension with a semi-autonomous collective foundation.

A comparison between semi-autonomous collective foundations and full-value insurance

Semi-autonomous collective foundation – the key points

- A collective foundation is a group of companies that manage their pension funds together. Each company can determine the amount of insured benefits for itself.

- Generally, the risks of death and disability are transferred to an insurance company.

- The retirement savings of the insureds (employees of the companies in the foundation) are generally pooled and invested directly in the capital market.

- The elected Board of Trustees (= representatives of the affiliated companies) decide on the investment strategy.

- When the financial situation is good, insureds can expect more interest on their retirement savings. Some of the generated returns are put into fluctuation reserves to serve as a “rainy day fund” for bad times.

Higher returns also mean more interest on retirement savings

With semi-autonomous pension solutions, the collective foundation bears the investment risk itself. But this also means that it can take full advantage of any investment opportunities. When markets trend higher, insureds benefit from higher interest on their retirement savings.

As far as corporate retirement funds go, this is a big advantage given today’s low interest rates and in view of demographic developments in Switzerland, i.e. the population pyramid and the shift from active insureds to retirees.

What does the risk look like with semi-autonomous pension funds?

Semi-autonomous collective foundations must also credit statutory retirement savings using the OPA minimum interest rate at the least, which in the worst case could lead to the collective foundation being underfunded in times when negative income is generated. Such instances are viewed as exceptions, particularly in the case of collective foundations with very robust financial and structural requirements (solid funding ratio, low technical interest rate, good aging structure, low ratio of pensioners, large percentage of additional voluntary retirement savings). A risk-aware and sustainable investment strategy with broad diversification provides additional stability.

Full-value insurance – the key points

- Full-value insurance is sold by life insurance companies.

- They bear the risks for death and disability, are responsible for the investment strategy and assume all investment risks. They guarantee that every year they will pay at least the statutory minimum interest on their insureds’ OPA retirement savings.

- Strict regulations “only” permit conservative investment strategies (so the equity component is < 5%), giving full-value insurers little scope for earning attractive returns.

- Underfunding is not possible. Full-value insurers must always guarantee 100% of the pension benefits they promise.

Full-value insurance is under pressure

Guaranteed risk assumption has its price: As full-value insurance from life insurers is subject to strict regulations, pension funds are very conservatively invested, which often means that the equity component is less than 5%. This is why even in good investment years insureds can only expect to see scant interest that is barely higher than the statutory minimum interest rate. Persistently low interest rates, rising life expectancy and stiflingly strict investment rules make it difficult for full-value insurance to generate returns that are capable of financing the extensive guarantees that are required. This results in either unattractive risk premiums that are hardly in line with the market or highly selective admissions for new companies.

Our takeaway: Semi-autonomous collective foundation solutions offer more attractive prospects

Both semi-autonomous pension solutions and full-value insurance solutions have their pros and cons.

Semi-autonomous collective foundation

Advantages:

- Opportunity for higher interest on retirement assets

- Flexible investment strategy means potential for attractive returns

- Risk-aware and sustainable investment strategy with broad diversification for stability

Disadvantages:

- Underfunding is possible, although rather rare (exceptional scenario)

Full insurance

Advantages:

- Highly secure retirement savings

- Underfunding is not possible

- Complete risk coverage during the savings process

Disadvantages:

- Low interest, barely above the statutory minimum rate

- Difficult to generate attractive returns due to stricter solvency requirements and more conservative investment strategies (equity component < 5%)

A look at the Swiss pension fund market shows that demographic changes, rising life expectancy and prevailing low interest rates have put so much pressure on full-value insurance that many providers of full-value insurance solutions are switching to semi-autonomous solutions. The number of remaining full insurance providers can be counted on one hand.

To ensure that Swiss SMEs and their employees have sustainable and high-performing Pillar 2 solutions, AXA has only offered semi-autonomous pension fund solutions instead of full-value insurance since the beginning of 2019. This is because the "third contributor," i.e. interest, has a far bigger impact on semi-autonomous solutions with their broadly diversified asset allocations than on full-value insurance, where investment options are heavily restricted by regulations.