Sales advice: 052 244 86 00

If your home is broken into, the basement flooded following a storm or if thick smoke makes your cloakroom unusable, you can still stay fully relaxed if you have AXA's household contents insurance. We insure your household contents in full and ensure quick and straightforward processing if you have to make a claim.

If you are under 30 years old and you buy a personal liability and/or household contents policy, we’ll give you the first 3 months of your annual premium for free. The discount applies to annual premiums starting at CHF 60.

You always want to be able to feel safe and secure at home within your own four walls. Insurance protection from AXA ensures that even after water damage or burglary and theft, you do just that thanks to broad risk cover and quick, uncomplicated help. The insurance protects you against these risks and their financial consequences. Find out here how the insurance is structured, what basic cover is included and which additional benefits you can choose:

Through its modular structure, household contents insurance from AXA can be expanded in line with individual needs as a type of "household contents accidental damage". This way you only insure what you want to and only pay for other benefits you actually need, such as protection for your art collection or house keys.

Different things are dear to people. You can have your personal favorite possessions comprehensively insured with these benefits - against damage caused by other people or by you accidentally, exactly as against loss or theft.

Yes, mobile devices (mobile phones, tablets, notebooks) are covered if you have taken out the supplementary all-round protection module "Smartphones, tablets and consumer electronics." Basic household contents insurance only covers your smartphone against damage from fire, water, natural hazards and theft.

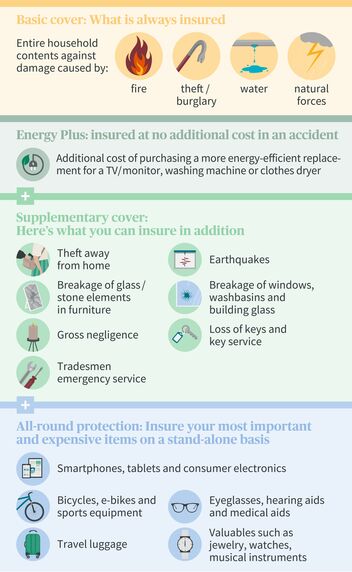

Household contents insurance is divided into basic cover and supplementary cover.

Basic cover insures damage to your household contents due to fire, theft or burglary, water and to events caused by natural hazards.

With supplementary cover, you can insure against other risks, such as gross negligence, theft away from home and much more - individually depending on your needs.

This is ordinary theft. If you have included supplementary coverage "ordinary theft away from home" in your policy, your handbag (incl. identification documents, cellphone, etc., but excluding cash) is covered up to the agreed sum insured. The costs of replacing your ID, documents, personal subscriptions, etc. is covered. In an emergency we can organize a key service for you within 24 hours – just call us on 0800 809 809.

In this case there is the supplementary coverage module "Loss of keys and key service": This coverage assists you if you lose a key or lock yourself out. Your keys to your own apartment are covered together with third-party keys such as those belonging to an association or a business. The supplementary coverage pays the costs for the key service, for replacement keys and for changing the locks.

With all-round protection for luggage, the costs of necessary purchases are covered up to CHF 1,000. If your luggage never arrives, the costs for replacing the lost items are also paid up to the agreed sum insured.