Taking care of your loved ones’ future Individual order of beneficiaries

Set up an order of beneficiaries so you decide who is entitled to any lump sum payments in case you die before you retire.

The following information applies to:

If an insured dies, in certain cases the survivors will receive a lump-sum death benefit. Your employer’s occupational benefits plan determines whether and to what extent a lump-sum death benefit is insured. The amount of the lump-sum death benefit can be found on your pension fund statement. This amount is provisional, as it can only be precisely calculated after your death.

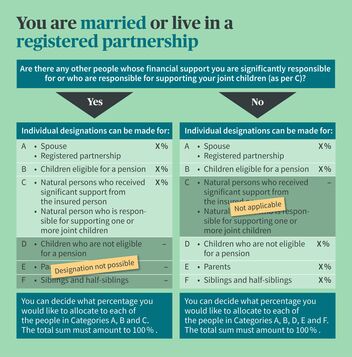

When a lump-sum death benefit is paid out, the occupational benefits fund regulations define which people are entitled to it. This is what is known as the “order of beneficiaries.” Typically the order is as follows:

You can change the order of beneficiaries listed in the occupational benefits fund regulations to adjust it to your personal situation. In other words, based on what is legally permissible, you can determine which people receive what percentage of the lump-sum death benefit. Depending on your circumstances and family situation, this may give your more or less flexibility.

The following general rule applies: If there is no person from group C – that is, no person(s) who are primarily supported by you or who are responsible for supporting your joint children – you can distribute the lump-sum death benefit as you wish among the remaining groups.

The following general rule applies: If there is no person from group C – that is, no life partner and person(s) who are primarily supported by you or who are responsible for supporting your joint children – you can distribute the lump-sum death benefit as you wish among the remaining groups.

Please note: Since family situations change during the course of a lifetime, a lump-sum death benefit is only paid out based on the actual situation at the time of death.

Remember to regularly check your order of beneficiaries and adjust it when necessary. This is particularly important if your family situation changes, such as due to marriage, the birth of a child, the death of a family member or the end of a life partnership.

Send us the form “Individual order of beneficiaries” telling us how you wish your lump-sum death benefit to be distributed. List the name of each of your beneficiaries and the percentage they should receive. The total should amount to 100 percent. The information sheet contains all the key points you need to know.

You can change or revoke your individual order of beneficiaries at any time. If you want to make a change, please submit the “Individual order of beneficiaries” form again. If you want to revoke the designation, please use the “Revoke” form. On revocation, the statutory order of beneficiaries will apply.

This depends on the individual and the retirement plan. The amount of the lump-sum death benefit is listed on your personal pension fund statement which you receive once a year. If the lump-sum death benefit as per the pension plan depends on the accrued retirement assets, then the amount on the pension fund statement is a provisional amount that can only be determined once you have died.

Yes, you can change or cancel your individual order of beneficiaries at any time. This is particularly important if your family situation changes, such as due to marriage, the birth of a child, the death of a family member or the end of a life partnership.

It goes into effect as soon as the form has officially been received by the pension fund and provided it has been correctly filled out.

After the pension fund receives your order of beneficiaries, it checks the form to see whether it has been correctly filled out. However, many things can change in your personal life after you have submitted the form. This means the pension fund can only determine whether paying out any lump-sum death benefit according to your wishes is possible after you have died. This assessment is made based on your personal circumstances and the legal and regulatory provisions at the time of your death.

A life partner is eligible if the couple has lived together for the past five years uninterrupted in the same household and domicile or if the surviving person must support one or more of the couple’s children. A person who survives the insured and was largely reliant on the insured for support is also entitled to the lump-sum death benefit. The exact provisions are laid out in the occupational benefits fund regulations.

Registered partnerships are deemed to be equal to married couples.

If you have any other questions, you can call us at 0800 809 810 or write to us at services.bvg@axa.ch.