What will change?

Gradual adjustment of conversion rate by 2027

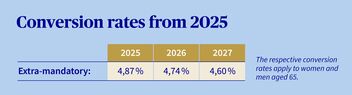

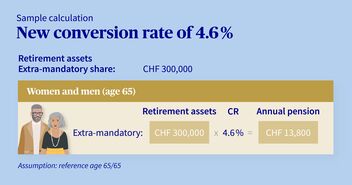

From 2025 to 2027, the AXA Foundation for Supplementary Benefits will gradually adjust its conversion rate to 4.6% for men and women aged 65.

The adjustment will take place over a span of three years. This means insureds can plan with greater reliability, and it cushions any pension reductions, especially for people who are about to retire.

The adjustment will not impact lump-sum payouts or existing pensions.

Prospect of higher interest income for insureds

By adjusting the conversion rate, the AXA Foundation for Supplementary Benefits reduces the increasing redistribution so that more of the investment return will be available to pay interest on retirement assets. The present interest model was therefore adjusted with effect from January 1, 2025.

Even an additional half of a percentage point in interest has a significant impact over the long term, as the following example shows:

- CHF 100,000 in starting capital, earning interest at 1.0% a year over 20 years, grows to CHF 122,019

- CHF 100,000 in starting capital, earning interest at 1.5% a year over 20 years, grows to CHF 134,685

- CHF 100,000 in starting capital, earning interest at 1.0% a year over 40 years, grows to CHF 148,886

- CHF 100,000 in starting capital, earning interest at 1.5% a year over 40 years, grows to CHF 181,401

The Board of Trustees is determined to provide a fair distribution of funds for all generations. To this end, it also introduced a pension participation model in 2025. Insureds will benefit from the Foundation's strong performance even after they retire.

Insureds can count on robust supplementary pension provision that offers capital protection and pension options at fair conditions.