Swiss inheritance law is over 100 years old: Within the scope of a partial revision, the law has now been modernized, addressing the needs of various lifestyles and offering more freedom to testators. The reduction in compulsory portions also makes company succession within the family easier: Business owners can allocate a freely chosen share of ownership to the successor – and thus strengthen their position.

The Federal Council has decided to put the revised inheritance law into effect on January 1, 2023.

It also provided Parliament with a legislative proposal on June 10, 2022, which includes additional provisions designed to make company succession easier: Individual heirs should – under certain circumstances – be able to demand allocation of controlling shares of the company. Moreover, other stumbling blocks for succession should be cleared with the calculation of the company's value at the time of takeover and the options regarding deferment of compensation payments.

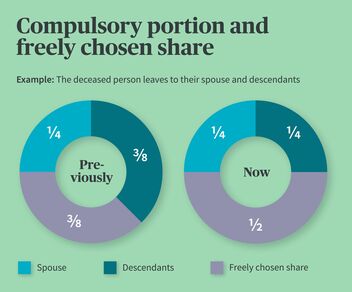

The law regarding compulsory portions has been liberalized, which makes succession planning easier for family-owned businesses. In the future, it will be easier to assign a company undivided to individual heirs.

At the same time, consideration is still given to equality among heirs.

Reducing and, in some cases, eliminating provisions about statutory compulsory portions adapts inheritance law to societal developments without fundamentally changing its structure. Testators have greater flexibility in their estate planning.

If the company will be sold to a successor outside the family, then the case is clear: The sales proceeds go to the assets of the seller and become part of the estate after their death.

The same applies to succession within the family. The problem arises in practice: Heirs are often unable to pay the full market price. However, if the company is assigned at a price below its market value – for example by means of a gift – the issue of a breach of the obligation of compulsory portions arises. The compulsory portions must otherwise be settled through freely disposable assets of the testator.

Legal inheritance claims also remain unchanged. To withdraw a legal inheritance claim, a last will and testament is still required. In general, a last will and testament drawn up before the revision to inheritance law shall remain valid.

This partial revision will have a major impact on many private individuals. However, self-employed persons and SME owners can also incorporate the impending legal changes into their succession planning today. In complex cases, it is advisable to consult an expert.

The temporal application of the rules on the conflict of laws provides for the newly reduced rules on compulsory portions to apply provided the testator passes away after the partial revision takes effect on January 1, 2023. This means that if you do not do anything, the new regulations on compulsory shares will apply.

As a rule, companies are transferred during the lifetime of the owner. However, until now the value of the company has been valued at the time of death of the testator.

This can lead to the misplaced incentives since the buyer has an interest in a company valuation that is as moderate as possible. The reason for this is that an increase in the company value between the transfer of the company and the death of the testator can lead to higher compensation payments to other family members who are entitled by law to a compulsory portion.

According to the legislative proposal of the Federal Council, the value of operationally essential business assets is to be included in the market value of the company at the time of assignment. Not only does this mean that the successor bears full entrepreneurial risk, but also that the increase in the company’s value would be excluded from any obligation to make compensation payments.

Until now, it has been possible to settle company succession in court by means of division proceedings. However, according to the legislative proposal of the Federal Council, the court should be able to decide if several heirs claim assignment of the company. The company would then be assigned to the person who seems best suited to take over operations. Good arguments in favor of a person include previous work within the family business or specialist qualifications, for example.

The successor remains fully obligated to make compensation payments to other family members.

To protect other heirs, the compulsory shares should not be paid through the minority holdings of the company. The goal of the changes to the law is to ensure flexibility and at the same time stability with regard to intergenerational company planning.

The Federal Council has included a deferment option for compensation payments of company successors to other heirs: The compensation payments can be deferred, or postponed, for up to ten years.

A deferment option is also provided for with regard to matrimonial property – although the requirements for the deferment option differ from those applicable to heirs.