Many Swiss doubt whether they will be able to have a worry-free retirement. A representative survey by AXA shows that the coronavirus pandemic has made people worry more about retirement provision. The importance of Pillar 3 continues to rise.

Retirement provision has been a concern for the Swiss for years and is regularly at the top of the list of worries. An AXA representative survey of more than 1,000 people in German-speaking and French-speaking Switzerland shows that most respondents worry that the pressure on retirement provision will intensify due to the economic challenges following the coronavirus crisis. Almost half of respondents are also more worried about their own pension situation, and around one third of them plan to take or have already taken appropriate action, such as investing more in Pillar 3 or buying into Pillar 2.

Practically half of the Swiss population between the ages of 18 and 65 assume that they will be able to maintain their accustomed standard of living in retirement, but only one in five is confident that this will be funded by Pillars 1 and 2, i.e. OASI and occupational pensions.

The widespread skepticism about future pensions from Pillars 1 and 2 stems in particular from rising life expectancy, the constant reduction in conversion rates for occupational pensions, the lack of trust in politicians regarding retirement provision reforms and the continuing low interest rate environment.

Retirement provision in Switzerland is designed so that Pillars 1 and 2 guarantee pension income after retirement of around 60% of the recipient's final income level, thus enabling accustomed standards of living to be maintained in retirement. On the whole however, many future retirees will no longer reach the originally planned 60% of their final income level for retirement from Pillars 1 and 2. As a result of rising life expectancy, the continuing low interest rate environment and the related challenges in OASI and occupational pensions, benefits from Pillars 1 and 2 are constantly decreasing.

At the same time, more than half of respondents said they would need at least 60% or even more than their final income level to be able to maintain their accustomed standard of living in retirement. The expectations for retirement are therefore high, while the benefits from occupational benefits funds are being constantly cut back.

As Kristian Kanthak, Head of Private Pension Provision, AXA Switzerland, says: “In many cases and depending on the pension solution, it's no longer sufficient for future retirees to depend solely on Pillars 1 and 2 if they want to maintain their accustomed standard of living. The majority of respondents appreciate taking more responsibility themselves and even consider it their duty as the state or employer to make sufficient financial provision for their retirement. There is a correspondingly great need to save independently under Pillar 3 in order to close the increasingly larger gap in retirement provision."

Currently around three-quarters of the 18-to-65 age group said that they are saving in Pillar 3a, which is a slight year-on-year rise (+4 percentage points). According to the survey, the majority of those saving for a pension have still opted for a classic 3a solution - almost 30 percent are relying on a securities solution such as an occupational benefits fund. However, the proportion who have chosen a securities solution with a higher earnings potential has increased significantly since 2019 from 17 to 29 percent (+12 percentage points).

According to AXA's survey, common reasons for not choosing a securities solution are the widespread perception that they don't know enough about the topic or that securities are less secure.

Kristian Kanthak: "Those who park their private pension in a classic account will today earn at most only 0.2% or less in interest. For the long-term investment horizon in particular, 3a solutions in the form of a securities fund with a corresponding equity portion offer significantly higher earnings potential. If compound interest is included, this could help generate a substantially higher retirement pension. Many of those saving for retirement could exploit the potential of Pillar 3 much better."

A clear majority of respondents support additional options for individual pensions saving, with most of them in favor of increasing the maximum contribution into Pillar 3. A majority of respondents would also welcome being able to make back-payments into Pillar 3 (i.e. retrospective payments) for an earlier year. This option is particularly popular with women who currently work fewer hours or who used to work part-time. 90% of all respondents are also in favor of opening up Pillar 3 to homemakers - currently only those in employment can pay into Pillar 3.

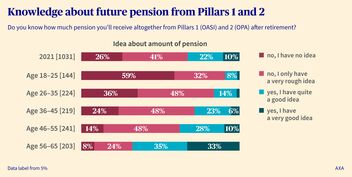

Although AXA's survey shows that retirement provision is a topic of concern or worry for many in Switzerland, more than two-thirds of respondents had no idea how much pension they would receive in retirement. More than 80% of young people under age 35 said that they had no idea about their future pension amount, and even in the 56-to-65 age group, i.e. those who are about to retire, one in three had no idea or only a very rough idea about how much pension they would be receiving. More than 70% of respondents would find it helpful to have a clearer overview of all benefits from Pillars 1, 2 and 3.

The majority of Swiss would like a simple, self-explanatory overview of all three pension pillars. AXA has therefore developed a digital pensions portal for its customers that creates transparency over their personal pension situation. Around 200,000 customers currently use the pensions portal. The portal is being constantly refined and optimized - today it already offers numerous self-services and simulation options for personal pensions.

About the study:

The market research institute Intervista was commissioned by AXA Switzerland to conduct the representative online survey between February 10 and 17, 2021, interviewing 1,031 people aged between 18 and 65 in German-speaking and French-speaking Switzerland. The survey was carried out for the first time in 2019 and repeated again in 2021 with additional questions (including ones relating to coronavirus).