Bike thefts cause millions in claims

AXA recorded around 9,000 stolen bicycles and e-bikes last year, resulting in a record claims amount of CHF 22 million. In the cantons of Basel-Stadt, Basel-Land, and Geneva, the probability of becoming a victim of bike theft was especially high.

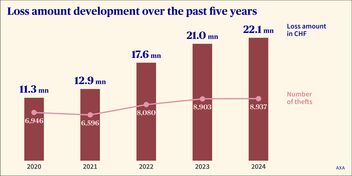

AXA, Switzerland’s largest property insurer, paid out over CHF 22 million for bicycle thefts last year – more than ever before. This is mainly due to the fact that bicycles are becoming more and more expensive and the number of e-bikes has increased – lucrative loot for thieves. An e-bike theft costs the insurance company an average of CHF 3,100. Across all bicycles – with and without an electrical drive – AXA paid an average of CHF 2,480 per theft. Just four years prior, the average claim was CHF 1,630, or around a third less.

The good news is that after steadily increasing in recent years, the bicycle theft rate did not rise again last year, but stabilized at a high level. The rate was 1.2 percent – in other words, every 82nd insured household reported a bike theft last year. Although this is still more than in 2022 and all previous years, it is slightly less than in 2023, when one in 80 households was affected. AXA counted around 9,000 stolen bicycles and e-bikes last year.

Caution advised in Basel and Geneva

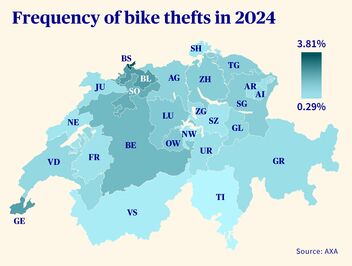

A look at the map of Switzerland reveals differences between the cantons: Basel-Stadt is and remains the top spot for bicycle thefts. Every 26th insured household had to report to AXA that a bicycle had gone missing. People in Basel-Land and Geneva were also very frequently affected. In the canton of Geneva, the bicycle theft rate increased significantly compared to the previous year, while a decline was recorded in the cantons of Solothurn and Lucerne Ticino, where only one in every 348 households have lost a bike to theft, seems to have the lowest number of thieves. The risk is nearly 13 times lower there than in Basel-Stadt. Valais also has a low rate (one in 205 insured households).

“We cannot conclusively explain the regional differences,” says Stefan Müller, Head of Property Insurance Claims at AXA. “One driver could be the proximity to the border, since there is more organized crime there which transports stolen bikes abroad.” “Being a city with a high number of bikes could be a further reason, as there is of course ample 'supply' for thieves.” The difference between urban and rural areas is also discernible in the statistic: Eight of the ten largest Swiss cities have a bike theft rate above the Swiss national average. Only Lugano and St. Gallen have a below-average value.

How to protect your bike

If you take some precautions, the risk of your bike being stolen can be minimized. “If possible, bikes should be parked where they can be locked and monitored,” Stefan Müller recommends. Securing the bike with a high-quality lock at a fixed location so that it can’t be simply taken away provides additional protection. If the bike is stolen anyway, the theft should be reported to the police as soon as possible. If you know the brand, exact model, and frame number, there is a greater likelihood that you will see your bike again. It is also advisable to register the bicycle or e-bike – for example, there are bike vignettes that allow you to register your bike online. “In addition to organized crime, which transports large quantities of bikes, we also see a lot of opportunistic thefts where a bike is used for one journey and then left again,” says Stefan Müller. So there is a chance of seeing the bicycle or e-bike again.

Insurance coverage for bikes

- Bike theft at home is automatically covered by household contents insurance.

- If your bike is stolen when you are away from home, household contents insurance will also cover the loss provided coverage for “ordinary theft away from home” is included in the policy.

- It is also possible to insure yourself against damage to your bike. At AXA, you can take out supplementary coverage for this purpose – “extended coverage for luggage, sports, and leisure equipment” – which can be especially worthwhile for expensive bikes.