14.06.2023

In 2023, adults saved an average of CHF 549 in health insurance premiums by switching their basic insurance. The greatest savings were made in the cantons Basel-Stadt, Geneva, and Vaud, and among 19- to 25-year-olds and women. For 2024 as well, there is potential for significant savings and signs of a great willingness to switch. For the first time in the Swiss insurance market, AXA is providing insights into actual switching behavior based on real switch data. The trend of “splitting” basic and supplementary insurance is continuing to pick up pace.

Last year, around every one in seven adults switched their basic insurance and, according to AXA’s latest study, thus saved over CHF 1,000 depending on their age group and category. There are similar signs of a high willingness to switch for 2024, which has the potential to bring about significant savings for the affected households.

According to the AXA study, the highest premium savings can be achieved by switching basic insurance providers combined with an increase in your annual threshold retention and a change of insurance model. For example, if an insured person with a free choice of doctor with a low annual threshold retention switches from provider A to provider B and takes out an alternative insurance model with a higher annual threshold retention (including any model with a fixed first point of contact, such as telemedicine, a general practitioner, or HMO practice), they save an average of CHF 1,633 per year – four times more than they would save if they only changed insurer and kept the same model and annual threshold retention.

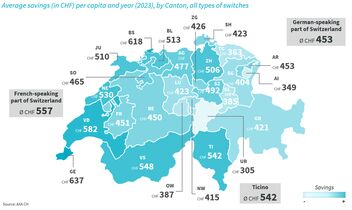

Not all people in Switzerland are equally willing to optimize their health insurance: Last fall, insured persons in Ticino or French-speaking Switzerland who switched health insurers were more consistent in optimizing their coverage than those in the German-speaking part of Switzerland. Residents in French-speaking Switzerland and Ticino not only chose a new insurance provider significantly more often, but they also switched to a new insurance model and adjusted their annual threshold retention.

According AXA’s survey, the highest premium savings (CHF 637) on average where achieved in the canton of Geneva, followed by the canton of Basel-Stadt with CHF 618. Overall, these cantons also have the highest premium level for basic insurance. People were also able to achieve significant premium savings if they switched in the cantons of Vaud (CHF 582), Valais (CHF 548), Ticino (CHF 542), Neuchâtel (CHF 530), Basel-Land (CHF 513), and Jura (CHF 510). According to the AXA study, the smallest cost savings were made in the canton of Uri with CHF 305.

The difference in lower premiums was especially evident among young adults under the age of 25. Here, women save an average of CHF 639 per person and year, while men save CHF 594. Why do young adults (19- to 25-year-olds) save so much more in premiums than those over the age of 26 even though they pay much lower premiums on average (approx. 70 percent compared to adult premiums)? "One reason could be the higher price sensitivity due to the phase of life they are in,” explains Niklas Elser. Often, 19- to 25-year-olds are still in education or training and have to pay closer attention to their expenses than many other older people.

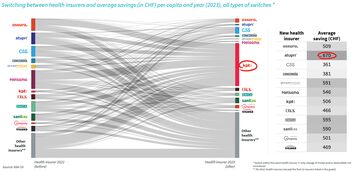

For the first time in industry, AXA Switzerland’s study is providing insights into actual switches from insurer to insurer in fall 2022 based on real results in addition to relevant facts for the individual households. KPT, based in Bern, drew the highest number of new clients. Viewed across all basic insurers, the greatest savings – an average of CHF 670 per year depending on the model and annual threshold retention – were achieved with a switch to Atupri.

The FOPH and industry experts expect premiums for basic insurance to continue to rise sharply in the coming year. Yet again, there is talk of a “premium shock.” According to AXA’s experts, this, in combination with the high social relevance, is highly likely to lead in fall 2023 to many switches among health insurers. “The politically desired ‘regulated competition’ in the basic insurance market will also come into effect this year and there will be a lot of movement in the market. Premiums have now reached a level that means for ever more people it is no longer an option to sit idly by,” says Niklas Elser, Head of Healthcare at AXA Switzerland.

So-called splitting, i.e. taking out basic and supplementary insurance from different providers, is becoming more and more attractive and has increased significantly, as shown by the data of the latest Accenture study. Splitting and the level of willingness to split among those aged 19 to 44 is considerably over 50 percent. Residents in Switzerland have recognized that by splitting basic and supplementary insurance between different providers they can often optimize their costs further. As of 2023, around every one in four people no longer have their basic and supplementary insurance with the same provider. That is ten percent more than last year. “We expect that with further increasing premiums in basic insurance, the trend of splitting will continue and probably even accelerate. In basic insurance, where the offers of health insurers are very similar and mostly interchangeable, people optimize according to the price; in supplementary insurance, where the offers often differ, people choose according to quality and individual preferences. This strategy obviously appeals to a growing number of people,” explains Niklas Elser.

For the first time in the Swiss insurance market, AXA is providing insights into actual switching behavior in the area of compulsory health insurance under the Federal Health Insurance Act (KGV) based on real switch data. It is based on 37,000 cases of a switch in basic insurance for which AXA's switching service was performed for AXA supplementary insurance clients in the fall of 2022 and which led to premium savings for 2023.

Around two million customers trust in AXA’s expertise in personal, property, liability, legal protection and life insurance as well as healthcare and occupational benefits insurance. With innovative products and services in areas such as mobility, healthcare, pensions and business together with simple, digital processes, AXA is a supportive partner for its customers. Using its «Know You Can» brand promise, it also encourages them to believe in themselves, even in challenging situations. Around 4,500 employees and the 3,000-strong sales force personally dedicate themselves to this vision. With more than 340 branch offices, AXA has Switzerland’s largest distribution network in the insurance industry. AXA Switzerland is part of the AXA Group and generated business volume of CHF 5.6 billion in 2022.