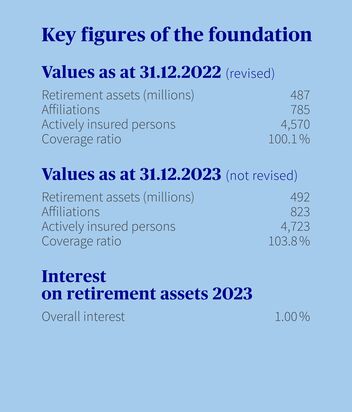

Key figures of AXA Foundation for Occupational Benefits

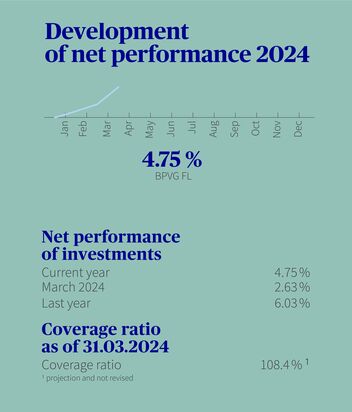

Performance of AXA Foundation for Occupational Benefits

The Board of Trustees of the AXA Foundation for Occupational Benefits is composed of the following members:

The management is responsible for the operational management of the Foundation, advises the Board of Trustees on strategic issues, and bears the responsibility for implementing the decisions of the Board of Trustees. The Board of Trustees is responsible for appointment.

Simplify your administration with myAXA, the central access to AXA's customer portals.

To the terms and conditions of use

Your links for lean administration

Website of the Liechtenstein Administration with links to all Liechtenstein offices and life topics

Portal of the Liechtenstein Administration (in German)

Information on the Liechtenstein financial center, in particular as bank, insurance and funds center

Laws of the Liechtenstein Administration – constitutional, private and criminal law, culture, defense, construction, social security, economy

Liechtenstein laws (in German)

Organization and commissions of the Liechtenstein Parliament, information about parliamentary sessions

Contributions, benefits of old age, survivors' and disability insurance (OASI), family allowances

OASI Liechtenstein (in German)

AXA, Pensions & Assets, Liechtenstein, Zollstrasse 20, 9494 Schaan

AXA.ch/vorsorgeschaan

Phone: +423 237 76 80

E-mail: schaan.vorsorge@axa.ch