Telephone consultation on offer for young people: 052 244 86 00

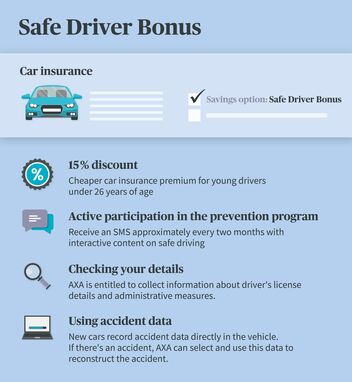

Choose the Safe Driver Bonus when taking out your car insurance policy and you'll be given a 15% discount. The infographic shows you what the Safe Driver Bonus savings option includes.

Great joy! You've now got your long-awaited driver's license in your hand and have just bought your first car. Here's some useful information so that you and your car are properly insured.

You always need liability insurance so that your vehicle can be registered in Switzerland. But are you unclear about what you need apart from mandatory liability insurance? We recommend one of the following types of insurance for better protection:

You are ultimately responsible for deciding whether partial accidental damage is enough or whether you'd rather be fully covered with comprehensive accidental damage. You'll find useful tips in our blog.

You can expand the insurance cover with additional options according to your needs:

In some cases, you can decide yourself how much the deductible should be. The advantage is that with a higher deductible, you pay a lower premium, but it also means that you have to cover this portion yourself in the event of a claim. You should therefore think carefully about the deductible so that it's at a level that you feel comfortable with. Because things can quickly become expensive in the event of a claim.

By choosing and taking out the Safe Driver Bonus as a savings option on your insurance. Your AXA advisor can give you more information.

Not yet insured with AXA? You can easily calculate your premium online and take out the policy directly online if you wish.

This is a voluntary savings option for everyone aged between 18 and 25 that gives you a 15% discount on AXA car insurance. In return, you agree to actively take part in the AXA prevention program on safe driving. AXA can also check whether measures such as confiscation of license have been taken against you. If there's an accident, AXA is entitled to select and use data from your vehicle for accident reconstruction purposes.

The prevention program is a fixed component of the Safe Driver Bonus. By taking out the Safe Driver Bonus, the young driver takes an active part in the prevention program on safe driving. AXA provides all the details about the program in a welcome letter. After that, the customer receives an SMS approximately every two months with short interactive content on the prevention program.

Newer cars record accident data directly in the vehicle. If there's an accident, AXA can select and use this data to reconstruct the accident. The data used is recorded by the control unit in the airbag, for example, including speed, acceleration, deceleration as well as date and time.

To enable you to choose the Safe Driver Bonus as a savings option on your insurance, you must be aged under 26.

With our electronics insurance, all your home electronics are optimally insured, both inside and outside the home. Regardless of whether your smartphone is dropped on the floor and the display cracks or your video camera is stolen.

With the AXA rental guarantee, you don't have to pay a deposit of three months' rent. AXA covers it for you. This way you can use your savings as you see fit and you retain your financial flexibility.

Your bathroom is flooded, your apartment has been broken into or a fire has ruined your built-in cooker: you can remain calm thanks to AXA household contents insurance.